ASML (Deep Dive)

''Never sell ASML'' - Full investment Thesis

1. Introduction

ASML is arguably the most important company in the world right now, a keystone player in the AI infrastructure revolution and in nearly all tech-related advancements. They are well known for their large moat, but in my opinion, ASML is still underappreciated by the masses.

It’s a company that’s hard to fully grasp and truly wrap your head around. In this deep dive, I will do my best to explain what ASML does and whether I think it’s a good investment or not.

Since I’m Dutch myself, I might be slightly biased. We Dutch people are quite proud of ASML. In the southern part of the Netherlands, I don’t think there’s a single person who doesn’t know someone working there. I think it’s truly special that such a big and important company resides in the Netherlands.

But don’t worry, I’m going to be as objective as I can.

Let’s dive in!

2. Origin Story

“ASML, the company that we are all proud of in the Netherlands.”

ASML was founded in 1984 as a joint venture between Philips and ASM International, with the goal of developing advanced photo-lithography systems for semiconductor manufacturing, that was dominated by Japanese firms back then. The new company, which was originally called ASM Lithography, was tasked with developing advanced lithography systems.

In 1998, ASML launched its first production tool and soon became completely independent from Philips. ASML was first publicly listed in 1996 on the NASDAQ and Euronext Amsterdam. This provided them with the much-needed capital to accelerate R&D and expand globally.

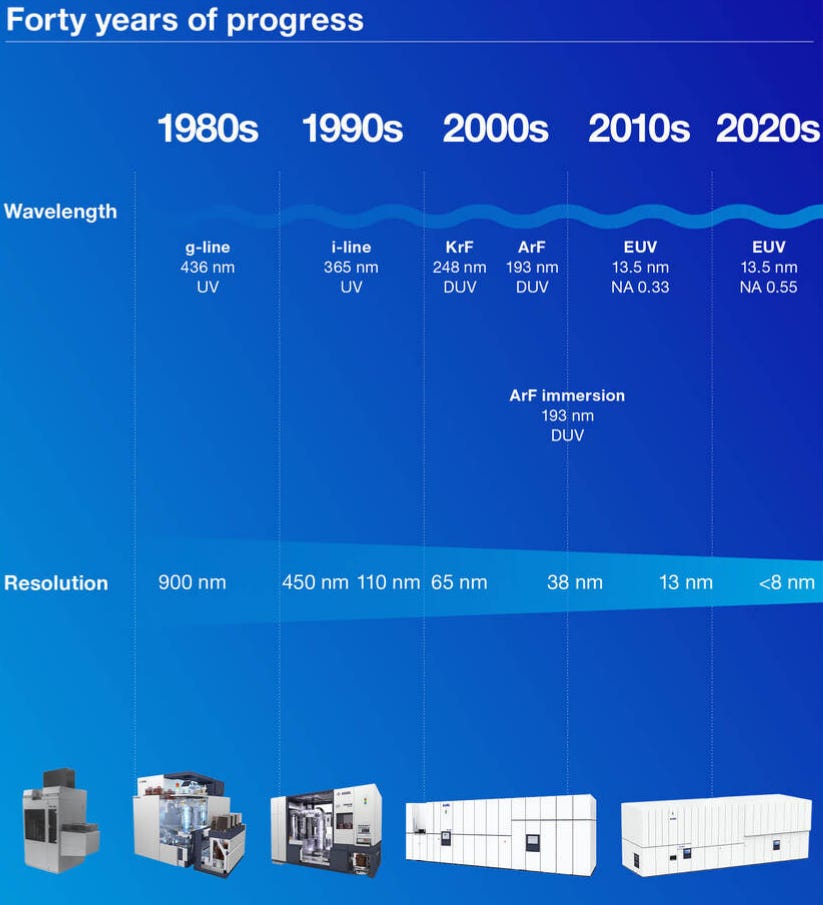

The 2000s were the period when things really started going. They introduced the TWINSCAN dual-stage system, which boosted productivity, and pioneered immersion technology, allowing chips to be made with even smaller features by shining light through water.

Then came the next big leap: Extreme Ultraviolet (EUV) lithography. Starting in the 2010s, ASML pushed the boundaries of physics, developing systems that use light of a shorter wavelength to create the smallest, fastest, and most powerful chips to date.

This required acquiring key partners like Cymer (light sources) and Hermes Microvision (metrology), forming a what ASML calls a “Holistic Lithography” strategy. More on that later.

By the 2020s, EUV moved into high-volume manufacturing, with ASML shipping its 100th system and later unveiling the High NA EUV (EXE) platform.

ASML’s differentiated strategy, deep co-development with leading chipmakers like Intel, TSMC, and Samsung allowed it to outpace competitors technologically and fundamentally.

Their decisive long-term bet on extreme ultraviolet (EUV) lithography cemented its position as the sole supplier of next-generation lithography systems, and it transformed ASML from a ‘‘small’’ Dutch startup into a monopoly-like enabler of global semiconductor innovation.

3. Company Overview

3.1 Geography

ASML produces lithography machines for the semiconductor industry. I will explain the concept of lithography and the role that ASML plays in the overall sector more in-depth later in this deep dive. For now, all you need to know, without ASML there won’t be any technological advancements.

ASML is headquartered in the Netherlands and they currently employ about 44,000 people. ASML’s headquarter is in Veldhoven. Veldhoven is a relatively small place close to Eindhoven, which is known to be one of the bigger tech-hubs in the Netherlands. ASML

ASML’s campus in Veldhoven is like a small village. It’s huge. It has R&D and manufacturing hubs, massive cleanrooms and large office spaces. There’s a large central plaza where employees can eat, work and dine.

In addition to their Veldhoven headquarter, ASML has different sites around the world, primarily in the United States, Germany, and Taiwan. At these sites they conduct their R&D, manufacturing, and they also have some refurbishing activities.

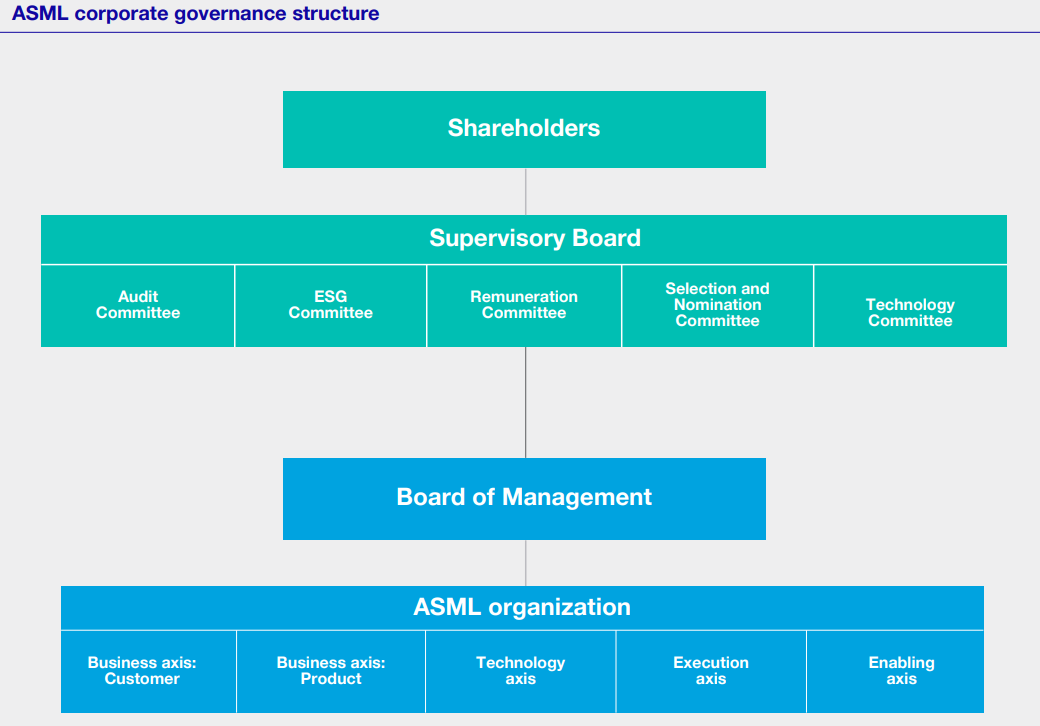

3.2 Corporate structure

ASML’s corporate structure is quite straightforward. They have a two-tier board structure consisting of a Board of Management responsible for managing the company, and an independent Supervisory Board which supervises and advises the Board of Management. For the fulfillment of their duties, the two Boards are accountable to the General Meeting, the corporate body representing all shareholders.

4. Management

4.1 General

ASML’s management is known to be very long-term and strategically focused. One could argue they are quite conservative in their approach and communication. Their two latest earnings call really illustrate that. They use very conservative wording, and are very dismissive of making concrete guidance projections.

ASML’s core business is still cyclical. But, even though that’s the case, management does not seem concerned about short-term results but always focusses on the bigger picture. Guidance is given years ahead (2030) and short-term guidance is not sugarcoated and sometimes even non-existent.

If they are unsure, they are not afraid to take a more conservative stance. While investors may not always like that, as was the case after their Q2-earnings report, I quite like the fact that WHEN they give guidance, you can trust it.

While some companies have fancy and shiny CEO’s and board members, that is not the case with ASML. Most of the higher-ups have a technological background and to me, they seem quite down-to-earth and result-oriented.

So, who are the top guys (no women in upper management yet) for ASML?

4.2 CEO - Christophe Fouquet

In 2024 Christophe Fouquet replaced Peter Wennink. Who led the company from 2013 and 2024 and achieved spectacular results with ASML. The stock price went up over 1000% under his vision and leadership. Very tough shoes to fill, but so far Christophe is doing an excellent job.

Christophe Fouquet became President and CEO in 2024, having served as Executive Vice President EUV from 2018 until 2022, Executive Vice President and Chief Business Officer from 2022 until 2024 and member of the Board of Management since 2018. Since joining ASML in 2008, he has held several positions, including Senior Director Marketing, Vice President Product Management, and Executive Vice President Applications, a position he held from 2013 until 2018. Prior to joining ASML, he worked for semiconductor equipment peers KLA-Tencor and Applied Materials. Christophe holds a master’s degree in Physics from the Institut Polytechnique de Grenoble.

He is known for having a strong customer-centered approach and a focus on technological innovation. He believes collaboration is the key to success, which perfectly aligns with ASML extensive network of partners and key suppliers.

4.3 CFO - Roger Dassen

Roger Dassen is the Executive Vice President and Chief Financial Officer (CFO) and a member of the Board of Management at ASML, having joined the company in 2018. Before his tenure at ASML, he held high-level positions at Deloitte, where he was the Global Vice Chair and a member of the Executive Board, and previously the CEO of Deloitte Holding BV.

Dassen is highly educated, holding a Master’s degree, a post-master’s in Auditing, and a PhD in Business Administration from Maastricht University. Beyond his executive role, he is active in academia and public service, serving as a Professor of Auditing at Vrije Universiteit Amsterdam and holding board positions, including on the Supervisory Board of the Dutch National Bank and as Chair of the Supervisory Board for the Maastricht University Medical Center+.

4.4 CSS - Wayne Allan (Chief Strategic Sourcing)

Wayne Allan is the Executive Vice President and Chief Strategic Sourcing & Procurement Officer and a member of the Board of Management at ASML, a role he took on in 2023.

He has a long and deep history in the semiconductor industry, starting his career at Micron in 1987 as a production operator. He moved up the ranks through various roles in engineering, planning, and production before eventually serving as Senior Vice President of Global Manufacturing Operations and Vice President of Wafer Fabs at Micron. Allan joined ASML in 2018 as the Executive Vice President of Customer Support before transitioning to his current sourcing role. He is primarily responsible for managing ASML’s supply chain and supplier relationships at a strategic level

4.5 CCO - James Koonmen (Chief Customer Officer)

Jim Koonmen is the Chief Customer Officer (CCO) at ASML. He was appointed to the Board of Management in 2024. He has been with ASML for a long time, beginning in 2007 when he joined through the acquisition of Brion, where he served as General Manager. On his way up he held many leadership roles as the CEO of Cymer (an ASML unit) and then five years as the head of the Applications business line.

Before joining ASML, Koonmen gained diverse experience in technology and operations, including roles at MEMX, Onetta, and Johnson & Johnson. He is highly educated, holding two Master of Science degrees from the Massachusetts Institute of Technology (MIT), one in Aeronautics and Astronautics and the other in Management from the Sloan School.

4.6 COO - Frédéric Schneider-Maunoury

Frédéric Schneider-Maunoury is the Executive Vice President and Chief Operations Officer (COO) at ASML, a position he has held since joining the company in 2009 (and was appointed to the Board of Management in 2010).

His role is focused on managing the entire scope of ASML’s operations. Before ASML, he held leadership and manufacturing roles at the power and transportation group Alstom, where he served as Vice President of Thermal Products Manufacturing and General Manager of the worldwide Hydro Business. Early in his career he worked in the public sector, holding various positions at the French Ministry of Trade and Industry. He is a highly educated engineer, graduating from the prestigious École Polytechnique and the École Nationale Supérieure des Mines in Paris.

4.7 CTO Marco Pieters

ASML recently announced the appointment of Marco Pieters as Executive Vice President and Chief Technology Officer. Pieters has been with ASML over 25 years. He will focus on ASML‘s technology roadmap with a strong focus on customers needs.

4.8 Management Execution + summary

In the last few years, ASML’s management has been quite conservative in their approach. And management’s word reflect that conservative stance.

Two quotes that perfectly illustrate management conservative stance are the following:

Q2 earnings report:

ASML cannot confirm growth in 2026

Q3 earnings report

ASML does not expect 2026 total net sales to be below 2025

There are many ways to phrase these guidances, but they seem to always take the most conservative way of communicating. Is it a sign of weakness or just conservative? I think the latter.

Overall, I like ASML’s management. They seem level-headed, focused and long-term oriented. That perfectly fits my investing approach.

5. Semiconductor market

Companies in the semiconductor market basically produce and sell ‘‘chips’’, which are integrated circuits made from silicon, that power computers, phones, cars, industrial machines and even AI systems. It starts with chip design and ends with manufacturing and packaging in fabs.

I expect ASML to continue playing a key role in this semiconductor market for at least the next decade and very likely way longer. Since they virtually have no competitors, and are a so-called monopoly, they are and will be the only player that can manufacture the machines for the most advanced microchips.

Without ASML’s machines, chipmakers like TSMC, Samsung, and Intel cannot produce their products, effectively making ASML the key bottleneck in the upcoming AI and datacenter transition and anything else that we need the chips for.

5.1 The TAM

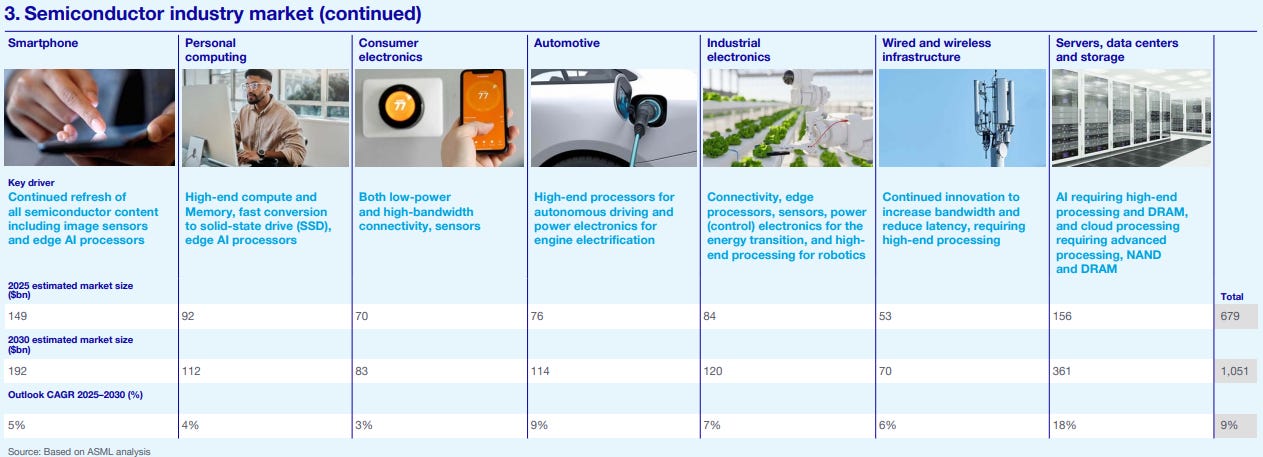

So, how big is this overall semiconductor market actually?

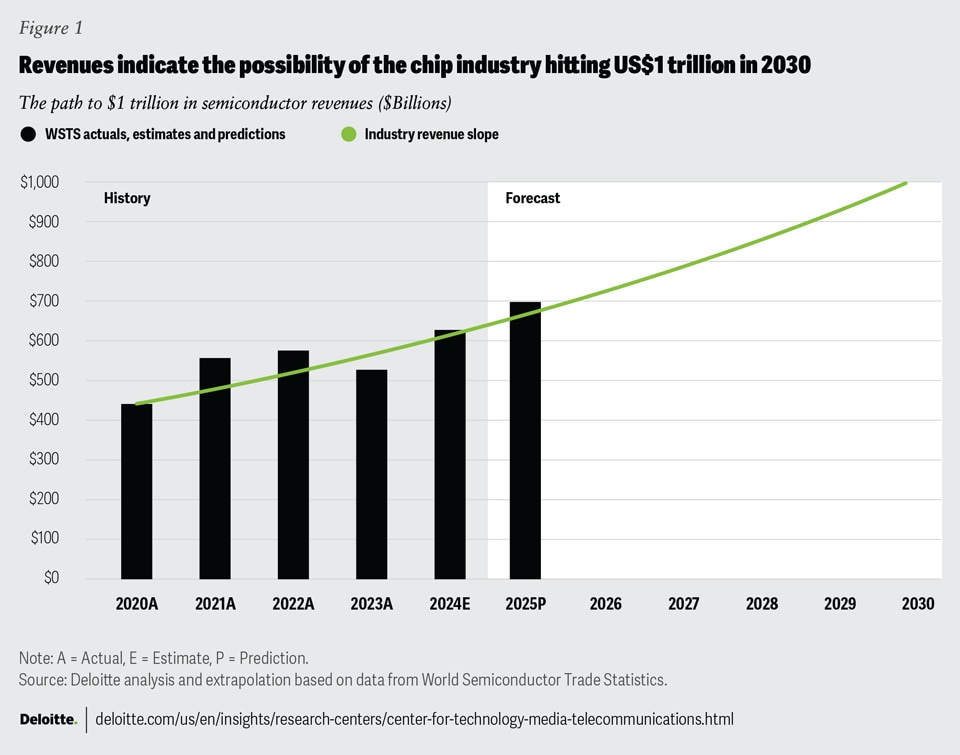

Deloitte estimates that the semiconductor market will grow to $1T revenue by 2030. This is almost a double compared to 2024, in which the total came in just above $600B.

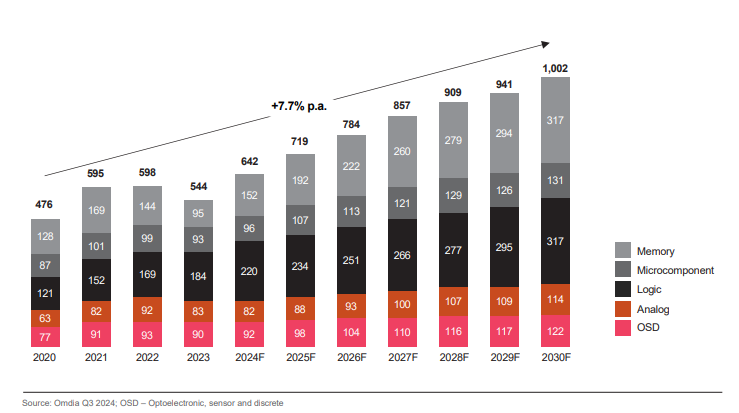

This growth trajectory is confirmed by PWC, as they came to the same conclusion. They also expect ‘‘the chip market’’ to reach $1T by 2030. This implicates a 7.7% CAGR from 2024 onwards. I expect ASML to exceed the 7.7% CAGR, but more on that later

Of course, this is the overall semiconductor market. ASML covers a smaller part of that. The semiconductor market is mostly shaped by two main segments: logic and memory. These two groups generate the largest share of the overall market’s sales, and that trend is expected to continue towards 2030.

Their dominance comes from the core function they perform across nearly all modern technology. Whether its the high-end computing, mobile devices, or specialized industrial and automotive systems, these specific components are absolutely essential.

The accelerating global demand for processing and storing data, driven by the massive infrastructure build-outs in cloud computing and the proliferation of AI applications and the Internet of Things (IoT) will most likely ensure a substantial need for increasingly faster and more efficient logic and memory solutions, and therefore ASML’s chips.

ASML believes they can capture between €44B and €60B in sales by 2030. (this equates to $51.20B and $69.81B, based on the current EUR/USD (as of 08-10-2025).

Simply put, ASML is part of a long-term growth trend in the semiconductor market. With all the AI developments, I think this growth might even accelerate towards 2030.

5.2 Cyclicality

One of the things some investors do not like about ASML and the semiconductor market, is the cyclical nature. One could argue this cyclical nature is even more prevalent in ASML itself, as they deal with the cyclicality of the overall market, but also the cyclicality and irregular lumpy revenue in their order books.

Net bookings don’t come in ‘‘gradually’’. since their machines are so expensive, and only a handful of big players can buy them, the orders come in fragmented throughout the business cycles.

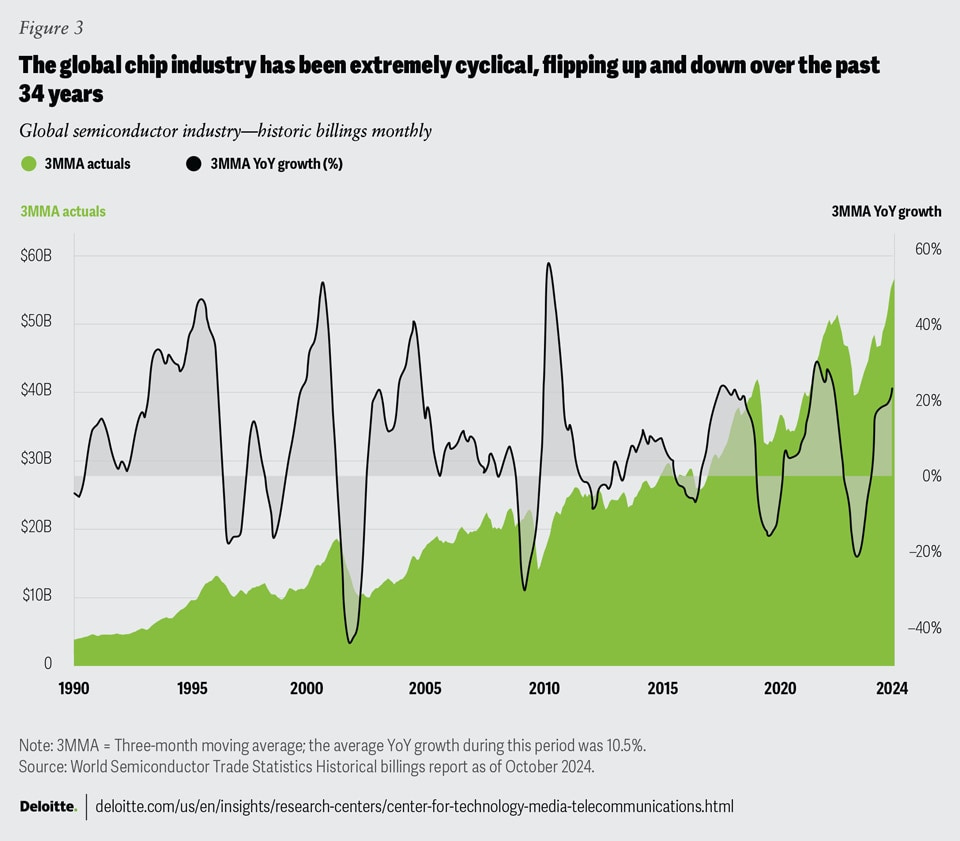

Personally, I’m not worried about this, as this is just inherent to ASML’s business, but it can provide for some short-term headwinds and volatility. Below picture perfectly illustrates the cyclicality of the global chip market.

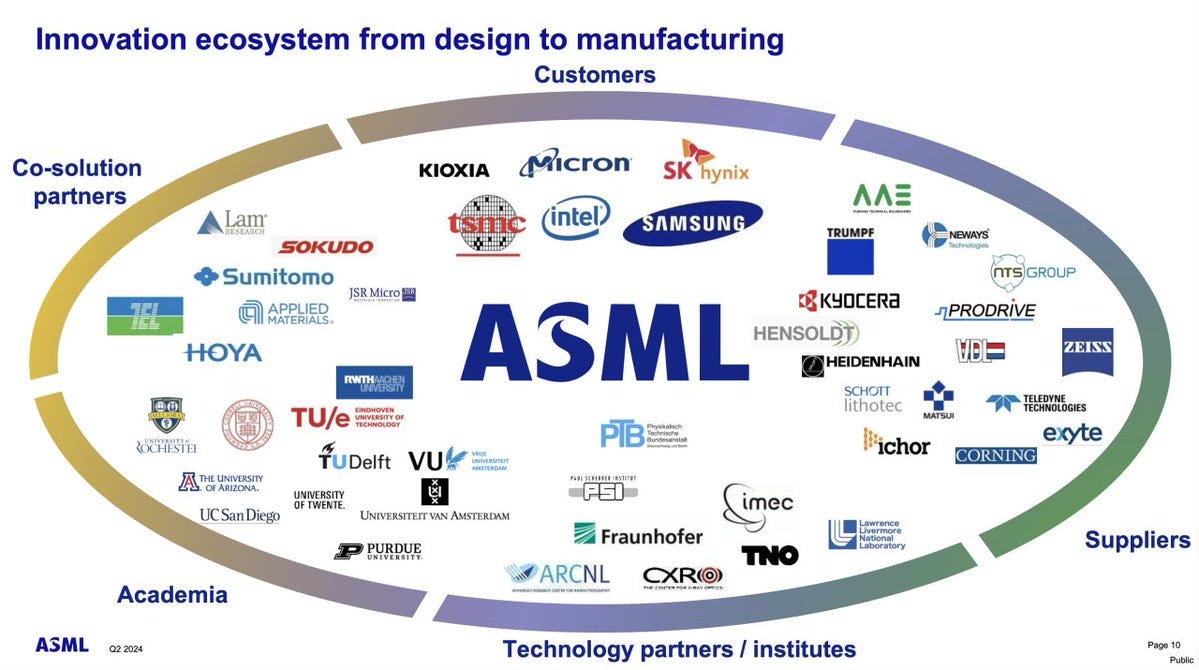

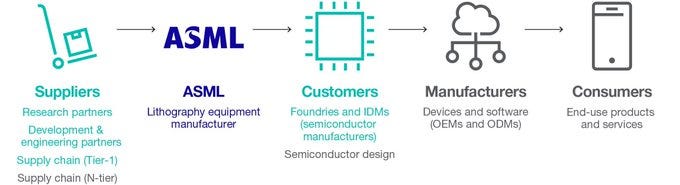

5.3 Semiconductor market ecosystem

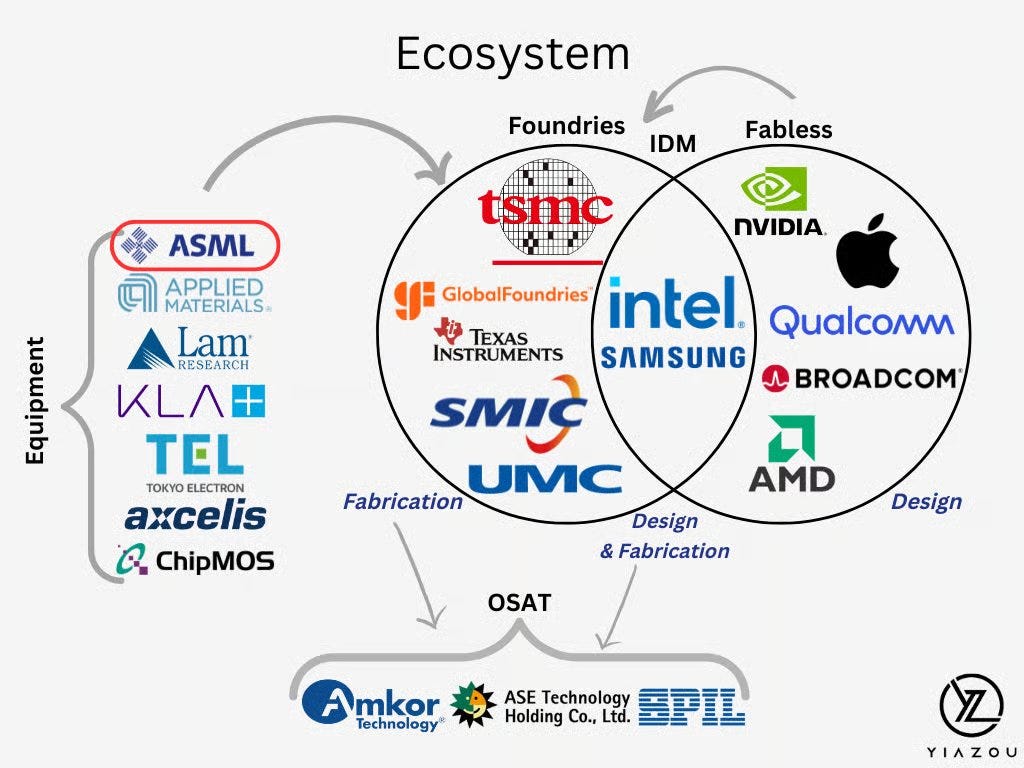

The semiconductor market is a difficult intertwined system. Companies cannot exist without each other. The below picture is a nice representation of the ecosystem ASML operates in. If I had to change anything, I’d put ASML in the middle. Without ASML’s machines, this ecosystem simply cannot exist.

A great example of how this works is the chain that follows after Nvidia. Nvidia designs the chips for its GPUs and AI products, but it relies on TSMC to manufacture them, making TSMC its exclusive fabrication partner. Take one hard guess where TSMC gets the machines to manufacture NVDA’s chips from. Yes, you guessed it right.

5.4 Summary

ASML is set up well to benefit from long-term tailwinds in the overall semiconductor market. Their cyclical nature can be seen as a negative point, but for anyone with a long-term mindset, this should not worry you. As demand for chips increases, so will the demand for the machines that ASML makes.

ASML is perfectly set up to be a key backbone player in the AI revolution, the data-center buildout rush we see, but also just the sheer technological advancements that await in the next decade. We WILL need ASML, to produce these machines to make it all happen.

I will go into ASML’s customers and other key players in the semiconductor market later in this deep dive.

6. ASML’s Machines

ASML makes most of it’s money through the sales of their machines. But there are a few other parts of their business that also contribute significantly, and could turn out to be a bigger and more important part their business in the future.

First we dive into what lithography is, and then we analyse the different machines and segments. I will try to not get too technical, so it’s easy enough to understand without a technical background.

6.1 Lithography

To understand why ASML’s machines are so important, we first have to understand the bigger context. The machines that ASML produces, are so-called ‘‘lithography’’ machines. I’ll explain in short what that means:

Lithography machines are precision devices that project patterns onto silicon wafers to create tiny circuits which are found in modern electronics.

Using light sources, masks with circuit designs, and complex optical systems, these machines “print” these patterns, which are then chemically developed onto a photosensitive material (photoresist) on the wafer. This process is repeated to build up complex 3D chip designs.

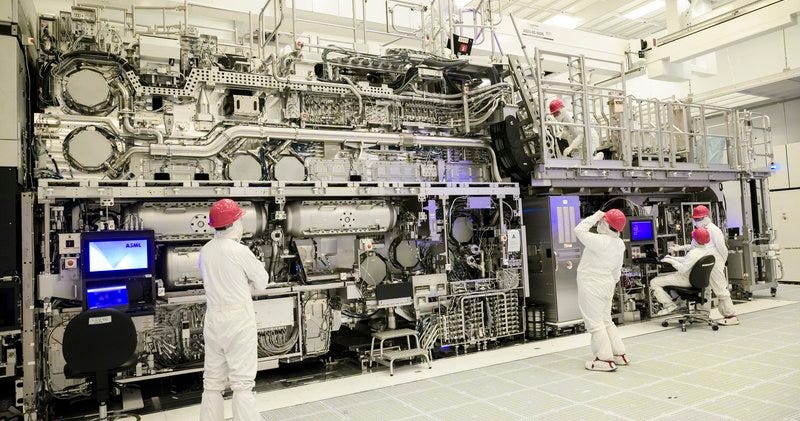

For reference, ASML’s machines cost about €300M on average, and their newest machines (high-na) cost up to €400M.

ASML’s machines have over 700,000 components. This total includes everything from the large structures to the individual parts required for chip lithography. To put this into perspective, a typical car has around 30,000 parts. This is not some ordinary machine.

It takes three Boeing 747 cargo planes to transport one current-generation EUV machine from ASML. Each machine is a logistical challenge, as its components are shipped in 40 freight containers, three cargo planes, and 20 trucks.

The video below explains perfectly how ASML’s machines work:

6.2 Moore’s law

So, ASML’s machines are used to produce chips. But how small are these chips? Well, there’s an ongoing search to make these chips ever more smaller and increase it’s computing power at the same time.

This is what we call: Moore’s law.

Moore’s Law is the observation and prediction that the number of transistors on an integrated circuit doubles approximately every two years, leading to exponential growth in computing power and a decrease in cost per transistor.

Gordon Moore, the co-founder of Intel, invented Moore’s Law in 1965, originally observing that the number of transistors on a microchip would double every year. He later revised this prediction to a doubling approximately every two years.

This isn’t a law of physics, but an empirical trend that became a guiding principle and motivation for the overall semiconductor industry.

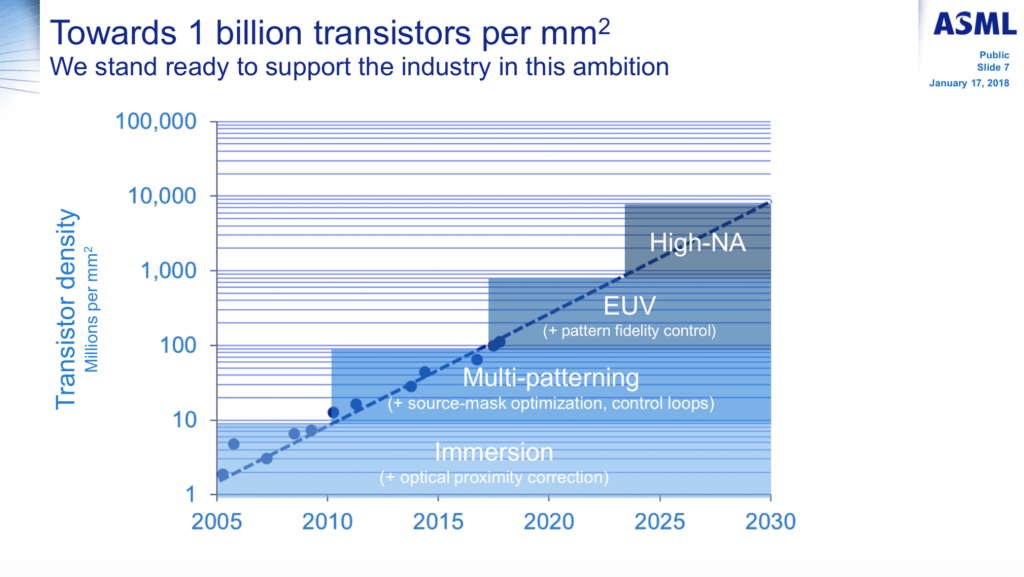

Below is an old slide, but it does paint a good picture of ASML’s roadmap during this chase of more compute and cost reduction:

Another, more recent picture shows the progress of the product range of ASML since 1980. We will cover the DUV and EUV machines next. ASML machines are capable of etching patterns as small as 8 nanometers, 1/10000 the width of a human hair

The two main segments for ASML’s business are DUV and EUV. We will cover these two first. Later we touch some different, lesser known segments which also contribute to ASML’s overall growth potential.

6.3 DUV

6.3.1 The systems

DUV (Deep Ultraviolet): These systems use DUV light (think 193 nm wavelength) and are widely used to mass-produce all kinds of logic and memory chips.

DUV lithography systems are the workhorses of the industry, producing the majority of layers in microchips. ASML offers both immersion as well as dry lithography systems, which use range of light sources to offer all wavelengths currently used in the semiconductor industry: argon fluoride (ArF) lasers for 193 nm wavelength, krypton fluoride (KrF) lasers for 248 nm and mercury vapor discharge lamps (i-line) for 365 nm.

These systems lead the industry in productivity, imaging and overlay performance and help manufacture a broad range of semiconductor nodes and technologies, and support the industry’s cost- and energy-efficient scaling.

6.3.2 Immersion and dry lithography

The distinction between immersion and dry DUV lithography lies in how light travels from the projection lens to the wafer, what may seem like a small difference actually has a major impact on resolution and chip scaling.

Dry DUV lithography is the ‘‘traditional’’ approach. In this method, there’s air between the lens and the wafer surface. The numerical aperture (NA), which determines how finely details can be printed, is limited by the refractive index of air (essentially 1.0). While this setup is simpler and highly effective for many mature semiconductor nodes, it eventually reaches physical limits in how small features can be printed.

Then we have Immersion DUV lithography, which introduces a thin layer of highly purified water between the final lens element and the wafer. Water has a refractive index of about 1.44, which allows the system to focus light more tightly, increasing the numerical aperture beyond what’s possible in air. This innovation effectively boosts resolution and enables smaller feature sizes without requiring shorter wavelengths.

Dry systems excel in cost-efficient production for established nodes and high-volume applications like sensors, analog chips, and power devices.

Immersion systems are used for advanced logic and memory manufacturing, where every nanometer of precision matters.

In essence, immersion lithography represents an evolution of the DUV platform, extending its usefulness deep into the nanometer era and bridging the gap between traditional optical lithography and today’s EUV technologies.

6.4 EUV

6.4.1 The system

EUV (Extreme Ultraviolet): This is ASML’s crown jewel. EUV machines use much shorter wavelength light (13.5 nm) to print the tiniest, most complex features on today’s most advanced chips. This shorter wavelength allows the machine to print features so small they are measured in a few nanometers, enabling modern processors found in smartphones and AI hardware.

Using EUV light at a wavelength of 13.5 nm, EUV lithography systems make it possible to print the smallest features on microchips at the highest density. They are used for the most intricate, critical layers on the most advanced microchips.

Since EUV light is absorbed by nearly everything, including air and glass, the machine operates in a near-perfect vacuum and uses a complex system of the flattest mirrors ever made, instead of lenses. The light is generated by blasting microscopic droplets of molten tin with a powerful laser fifty thousand times per second!

These EUV machines also help simplify ASML’s customers’ manufacturing processes, compared to complex multiple patterning strategies using deep ultraviolet (DUV) immersion systems. ASML is currently the world’s only manufacturer of these EUV lithography systems

ASML’s EUV machines aren’t allowed to be exported to China. DUV machines face some restrictions too, but they can still be sold there (for now).

6.4.2 HIGH-NA EUV

ASML is now rolling out High-NA EUV machines. High-NA EUV is the successor to the current EUV technology. Its purpose is to continue the industry’s ability to shrink chip features, enabling the move to 2nm process nodes and beyond. High-NA EUV machines are the most advanced generation of lithography tools out there right now.

The “High-NA” refers to the increase in the numerical aperture (NA) of the optical system, from 0.33 in current EUV to 0.55. This increase in NA is what gives the machine its higher resolution, allowing it to print patterns with a resolution of just 8 nanometers

To prepare High NA EUV (0.55 NA) for high-volume manufacturing, the first operational prototype was made available to chipmakers in the new ASML-imec High NA EUV Lithography Lab in Veldhoven campus. Two more TWINSCAN EXE:5000 systems were assembled and installed at an Intel plant near Hillsboro, Oregon and a fourth system was shipped to a customer in Asia.

In April 2024, the High NA EUV system in Veldhoven printed the first-ever 10 nm dense lines, with imaging done after optics, sensors and stages completed coarse calibration (see image on the right).

This important milestone showed the system is functioning, though not at full performance in a high-volume manufacturing environment yet

6.5 Metrology and inspections

Another part of ASML’s business, that is not so often talked about are their metrology and inspections systems. These systems enable chipmakers to measure printed wafers, which ensures they align with the intended designs. This supports chipmakers in optimizing patterning throughout every stage stage of the manufacturing process.

Inspection systems act as the fab’s early warning network. They scan wafers and masks for particles, pattern defects, and anomalies, classifying which ones threaten yield and which are benign. Optical inspection offers speed and coverage, while e-beam review tools confirm and characterize what truly matters.

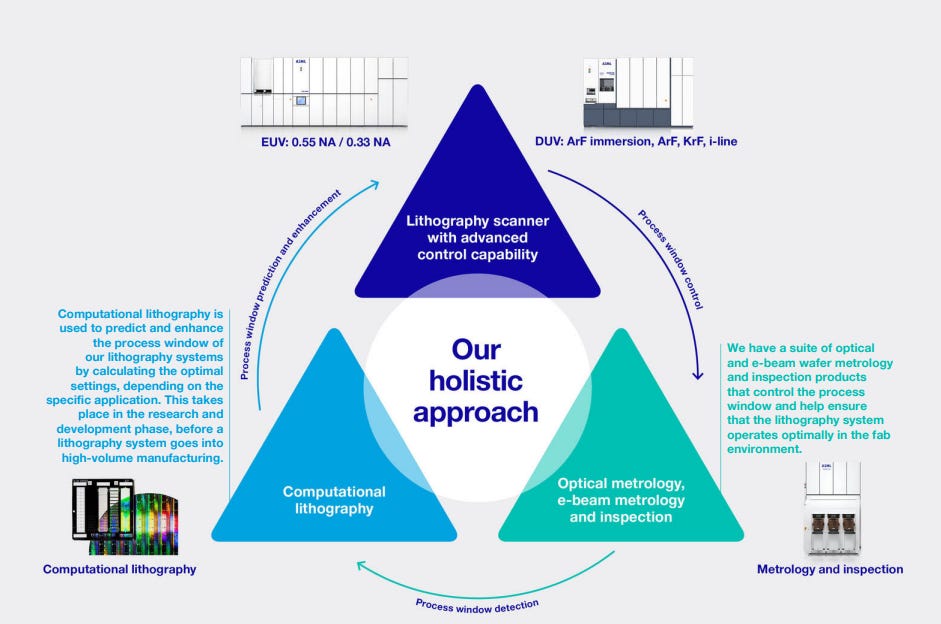

These systems play a key role in ASML’s ‘‘holistic’’ approach, which we will discuss later. This segment can be divided in two parts:

6.5.1 Optical metrology

Optical metrology is the frontline tool for process control. Using light to measure overlay, film thickness, and critical dimensions, it delivers fast, non-destructive data across thousands of wafer sites. These readings feed directly into ASML scanners’ control loops, adjusting focus, alignment, and exposure in real time to keep each layer perfectly registered.

6.5.2 E-beam metrology and inspection

Where optical methods reach their resolution limits, e-beam metrology steps in. By scanning with a finely focused electron beam, it reveals nanometer-level details line edge roughness, critical dimension variation, and feature profiles. Though slower, it provides the “ground truth” needed to calibrate optical models and diagnose root causes when processes drift.

Together, these systems create a sort of defense against error: fast optical control, high-resolution e-beam verification, and defect inspection. Without them, even the most advanced lithography tools couldn’t maintain the precision required to operate perfectly.

6.6 Software and maintenance

On top of building and installing these machines, another big part of ASML’s business is software and maintenance.

They develop advanced software that works with their hardware. This is important, because ASML isn’t just there to drop off a machine, they are THE key partner for their customers throughout this entire process.

Because these machines are incredibly complex and expensive, ASML offers full-on customer support: installation, maintenance, upgrades, and even training for chipmakers all over the world. Customers rely on them from start to finish.

6.7 Holistic approach

ASML prides itself in it holistic approach. So what does that mean?

ASML’s holistic approach to lithography: integrates advanced hardware, computational lithography, metrology, and inspection into a unified ecosystem that enables chipmakers to develop, optimize, and control every aspect of semiconductor production.

At the core of this approach is the process window, which is basically the range of acceptable process variations within which chips can be reliably produced to specification. By combining so called computational models, real-time metrology, and intelligent inspection, ASML empowers customers to maximize this process window, ensuring system stability and high yield in high-volume manufacturing environments.

The result is a synergistic fusion of high-precision hardware and advanced software, designed to sustain Moore’s Law scaling and deliver more functional chips per wafer, per day. This integration strengthens ASML’s competitive moat and sets them up to be a backbone player in next-generation semiconductor manufacturing.

6.8 Summary

ASML builds the world’s most advanced lithography machines, the systems that “print” microscopic circuits onto silicon wafers, forming the foundation of every modern chip. Their technologies drive Moore’s Law, enabling chips to become smaller, faster, and more efficient every year.

The company’s DUV systems handle most chip layers, while the EUV and High-NA EUV machines define the new, more cutting edge part of semiconductor manufacturing.

Alongside these, ASML’s metrology, inspection, software, and services ensure every chip layer aligns with perfect precision.

Together, this integrated ecosystem, hardware, software, and process control, makes ASML the backbone of the global semiconductor industry.

7. The customers

ASML has very high customer concentration. This makes perfect sense, as their machines are so expensive and complex, only a handful of players can order and use these machines. ASML’s key customers are:

TSMC

Intel

Samsung

SK Hynix

Micron

Kioxia

While some argue this customer concentration is a key risk for ASML, I actually don’t think it is. Whether it’s TSMC, or Intel or a new player entering the space, they HAVE to go through ASML to get the machines. Neither party benefits from squeezing the other party, as they are in this together. ASML and for example TSMC, are quite hesitant when it comes to raising prices, because if they do it too much, it will hurt the whole chain.

I will briefly explain what ASML’s customers do, and how the have been doing in the past years.

7.1 TSMC

TSMC is the world’s largest pure-play semiconductor foundry: they manufacture chips designed by other companies, at leading-edge process nodes and provide advanced packaging and manufacturing services.

TSMC has has some stellar years behind them, which is also reflected in the stock price. The share price is up 215% in the past 5 years.

Revenue growth CAGR last 5 year: 22.5%

EPS growth CAGR last 5 year: 25.5%

7.2 Intel

Intel is an integrated device manufacturer and chip designer: they develop CPUs, GPUs, and custom silicon while designing and operating its own fabs; they are now also expanding into foundry services and packaging solutions

Intel has not been doing great in the last 5 years, and I think that’s quite the understatement. Shares are down about 33% in the last 5 years as growth stagnated.

Revenue growth CAGR last 5 year: -7.6%

EPS growth CAGR last 5 year: -2.8%

Recently momentum has increased, after the Nvidia deal. Nvidia and Intel have announced a significant strategic partnership that includes a $5 billion investment from Nvidia in Intel stock. Intel also seems in favour of the US governement, which could provide some long-term tailwinds.

7.3 Samsung

Samsung is a vertically integrated technology giant: leading supplier of memory (DRAM, NAND), a major logic foundry and system-chip maker, and also (what most know them from) a large consumer-electronics business (phones, displays, appliances)

Over the past five years, Samsung had a rough time. But in 2025 Samsung has re-strengthened its position as a semiconductor leader. Driven by rising DRAM and NAND demand, AI and server growth, and strategic partnerships like its $16.5B Tesla foundry deal, they reclaimed the top spot in global semiconductor and the end of 2024. Despite U.S. restrictions limiting Chinese sales, Samsung’s diversified portfolio and technological advances continue to boost profits, with 2025 marking its highest quarterly operating profit since 2022.

Revenue growth CAGR last 5 year: 6%

EPS growth CAGR last 5 year: 7.2%

7.4 SK Hynix

Sk Hynix is a memory specialist: they focus on DRAM and NAND flash production for PCs, servers, mobile devices, and enterprise storage markets

Over the past five years, SK hynix grew strongly, driven by the surge in demand for high-performance memory chips, particularly in AI applications. In 2024 they reported a strong revenue increase, reaching approximately $46B, up from around $25B in 2023. This growth trajectory continued into 2025, with revenues surpassing $55B. A key factor in this success has been the strong focus and execution in the High Bandwidth Memory (HBM) market, where it holds a dominant share.

Revenue growth CAGR last 5 year: 21.2%

EPS growth CAGR last 5 year: 64.8%

7.5 Micron

Micron is a memory and storage company: they design and manufacture DRAM, NAND, and storage solutions (SSDs, embedded memory) for client, cloud, and industrial customers.

Micron rebounded sharply from a deep downturn in 2023 (when it posted large losses) to strong profitability in 2024 and 2025. Revenue jumped from $15.5B in 2023 to $37.4B in 2025. Growth has been driven by demand from data centers and AI, especially for high-bandwidth memory. Strong gross and operating margins, aggressive capital investment, and success in high-margin product lines have helped Micron regain momentum. This is also reflected in the stock price, as it is one of the best performing stocks in 2025. 100%+ YTD and 250% in the past 5 years.

Revenue growth CAGR last 5 year: 11.8%

EPS growth CAGR last 5 year: 26.2%

7.6 Kioxia

Kioxia is a Flash-memory company spun out of Toshiba: they develop and supply NAND flash and memory-based storage solutions for SSDs, mobile devices, and enterprise storage

Kioxia has rebounded from a multi-quarter dip. After strong losses in 2022-2023, they turned profitable in 2024, with revenue up ~80% YoY and solid operating and net income. Capacity utilization improved, and production scaled up, especially in high-stack NAND flash tech (112-layer → 218-layer). They also ended production cuts as market demand started recovering. Still, short-term pressure remains: in Q2 2025 revenues and profits dropped YoY due to slow demand in smartphone & PC markets and currency headwinds.

Still the share price is up %250 YTD.

Revenue growth CAGR last 5 year: 11.6%

EPS growth CAGR last 3 year: 36.6%

7.7 Summary

In general we can say: if ASML’s customers do well, ASML does well. Since Samsung and Intel, which complete the top 3 client list with TSMC, have been struggling in the last years, this was also reflected in ASML. TSMC has been performing incredibly well, and I expect them to continue doing so.

Right now, there seem to be quite a few tailwinds, pushing these companies higher and the overall market looks better than before (even for the falling angel Intel). With the AI revolution in full throttle, eventually, this should lead to more orders for ASML. As these customers scale, they need ASML, and it’s machines to do so.

8. The MOAT

I would argue, ASML has one of the largest and widest MOAT’s in the world. For the few of you who don’t know what a moat is:

A “MOAT” is a sustainable competitive advantage that protects a company from its competitors, much like a castle’s moat protected it from attack. This advantage allows a company to maintain profitability and market share over the long term, making it a more secure investment.

Most people think ASML’s moat is purely a technological one, but in this chapter I’ll break down why I think it’s a lot more diverse than just that. Let’s start with the IP MOAT.

8.1 IP MOAT

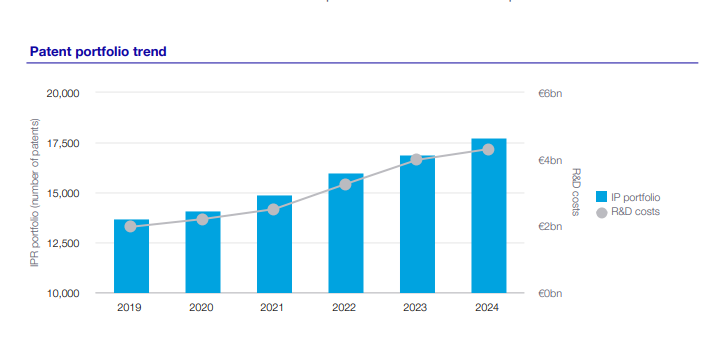

Something that’s not talked about enough is ASML’s IP MOAT (intellectual property). Decades of R&D and thousands of patents protect its EUV and DUV technology, making it nearly impossible to copy. ASML IP strategy is as follows:

Build and maintain a solid IP portfolio by protecting ASML’s inventions.

Prevent situations where ASML infringe on the IP rights of third parties.

They prevent the unauthorized disclosure of, including know-how and trade secrets, to the outside world. This not only keeps rivals out but also drives licensing value with chipmakers. In a world where semiconductors are strategic assets, ASML’s IP is arguably its strongest moat. And that is exactly why they spend over $4B a year on R&D and keep expanding the IP moat.

8.2 Partnership and supply-chain MOAT

ASML doesn’t just produce these machines themselves. They work together on R&D, optimization and production WITH their clients. And they start doing this YEARS sometimes decades) in advance. And when they have build them, they have long-term maintenance contracts to update and maintain these machines.

It took ASML decades to built their current supply chain. And I’d argue, this supply chain is what makes them unique. A delicate web of thousands of partners, working together to make the machines.

Each of these partners have their own specialties, and they have been woven into ASML’s production and maintenance processes throughout many years. I can’t emphasize how hard this is to replicate.

It took ASML decades to be a trustworthy partner for their clients AND customers. These clients will have a very high barrier-to-switch. When investing/buying such expensive machines, trust is arguably even more important than price.

8.3 Technology Moat

The part that’s constantly being talked about, is China catching up on a technological level. While the Chinese have a tendency to innovate, and catch up on literally everything you can think of, I think they are not a threat to ASML (yet).

ASML’s management agrees with me. The management acknowledges China’s significant push toward semiconductor self-sufficiency but they emphasize that China remains a decade or more behind compared to the West when it comes to advanced chipmaking technology.

CEO Christophe Fouquet has repeatedly stated that U.S. and Dutch export restrictions on its advanced Extreme Ultraviolet (EUV) lithography machines have created a technological chokepoint that China cannot overcome in the near term. However, China’s hand is forced by these restrictions. They will do everything in their power to overcome and survive.

8.4 Expertise moat

Another part of their moat that is underappreciated is the expertise moat. I’m referring to the expertise of the people working for, and with ASML. Employees at Samsung, Intel and TSMC are trained with ASML machines in mind. They have been trained like that for years, decades even.

All processes, equipment in fabs and guidelines are built around ASML’s way of working. This knowledge will not be easily set aside and let go to waste. It will be tough for these companies to decide to switch, as it will take years and years to re-train their employees to learn other machines and processes.

8.5 Data MOAT

ASML collects vast amounts of real-time operational data from every machine operating in the fabs of its major customers (like TSMC, Samsung, and Intel). This data covers everything from laser firing and molten tin droplet placement to mirror alignment with nanometer precision, and the final chip-printing performance.

This creates a powerful data flywheel: more machines sold means more unique data collected, which leads to better-performing machines and services, which then secures more sales.

Competitors lack the foundational technology to even build a similar machine, and critically, they also lack the decades of production data necessary to make such a machine commercially viable and productive for chipmakers.

8.6 Moat under pressure?

Is their MOAT under pressure? I don’t think it is, it’s just to big. There are quite a few issues surrounding ASML right now. But their MOAT is not one of them.

It’s so wide and deep as I highlighted in this chapter, I think it will take decades for other manufacturers to catch up to them. There’s not many companies that can do it in the first place, imagine the amount of CAPEX you have to spend to close in on ASML.

9. Competitors

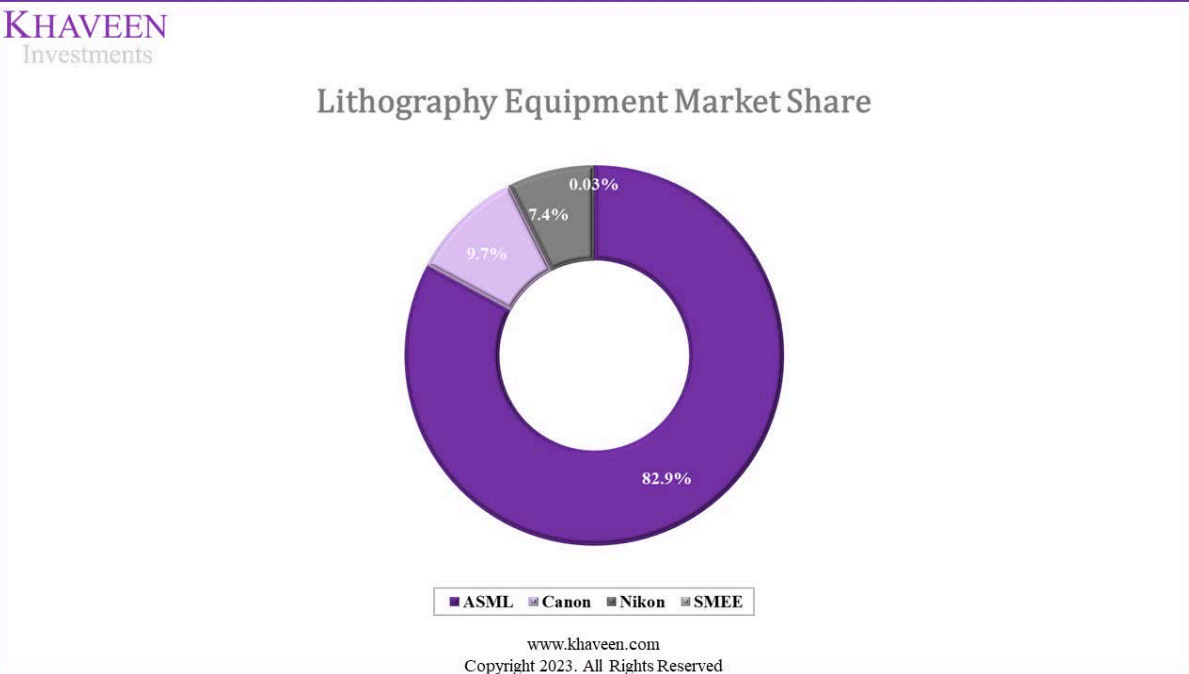

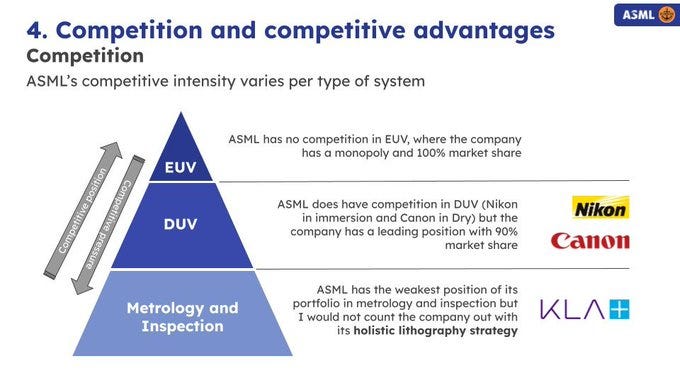

This is gonna be a short chapter, as there aren’t any significant competitors to ASML in my opinion, especially when it comes to their EUV business.

The main reason ASML is so hard to compete with is because they have a total monopoly in EUV technology. I explained their moat in the previous chapter, which highlighted the unique position ASML is in.

Nikon and Canon, which could be labelled as competitors, also sell DUV lithography machines, but they mainly serve older, less advanced chip technologies and their market share is very small (below 20% combined).

Getting EUV technology to work took decades and billions of dollars in R&D. It required massive breakthroughs in physics, optics, materials science, and crazy-precise engineering.

This isn’t something a competitor can just figure out in a few years. It’s basically impossible to copy from scratch. Personally, I think it will take at least 10 years for another company to even come close to what ASML is doing right now.

There are some competitors in China, like SMEE and Huawei, but they are not even close to what ASML does. Still, worth to watch as you can never underestimate what the Chinese can do when their hands are forced.

10. ‘‘ASML’s fall from grace’’

While other semiconductor companies have been absolutely flying these past years, ASML has been performing quite poorly. Recently the price has spiked, but ASML was trading almost flat for the majority of the last 5 years. Of course, prices were volatile and there was still money to be made.

So, why did the stock price fall in 2024? There are many reasons, but in this chapter I’ll highlight the most important ones.

10.1 EUV Machines ban in China

Let’s start with the big one: US forced ASML to stop the export of EUV machines to China. In 2023-2024, export licenses for some of the newer/advanced DUV immersion machines were also revoked (or made subject to stricter licensing) by the Dutch government.

The reasoning behind it is national security and technology containment. The politization of ASML’s business is of course not good for their growth potential. If governments interfere with there business strategy, like they have done, it can and will limit their options for expansion.

As we can see later, China still makes up a large part of ASML’s sales, so this definitely cuts in their growth potential.

10.2 Geopolitical challenges - Taiwan invasion

Another risk that is often mentioned, is China invading Taiwan. While I think we have a lot more to worry about when and if that happens, the rationale behind it is simple: TSMC, ASML largest customer, is from Taiwan. If China were to invade Taiwan it could potentially cut of TSMC from the world and that would absolutely cripple ASML’s business with TSMC.

I see the likelihood of this playing out as extremely low, but it is something to keep in the back of your mind when investing in ASML.

10.3 Tariff uncertainty

While some of the tensions around the Tariffs War have died down, ASML still feels the pain of the initial uncertainty. Customers were hesitant to make any big decision as the Tariff War was in full force. I would argue they still are hesitant, as it remains unclear as to what the exact implications will be from enforced tariffs.

As long as Trump remains president, I think we will always have a difficult market environment for companies to truly make any big plays on the worldwide playing field.

10.4 Supply chain restrictions

Besides the more (geo)-political issues, there are some issues closer to home as well. ASML’s main supply chain issues in recent years stem from:

Component shortages: Scarcity of precision optics, rare materials, and custom parts with long lead times.

Factory disruptions: A 2022 Berlin plant fire and other localized incidents delayed key subassemblies.

Capacity limits: Demand for EUV/DUV tools far exceeds production capability, causing order backlogs.

Supplier shifts: Moving suppliers to Asia for cost efficiency introduced quality and logistics risks.

Geopolitical risks: Dependence on rare earths and complex cross-border logistics exposed ASML to political and material supply shocks.

This combination of factors led to an increased negative sentiment around ASML. We dive later into whether that was justified or not when we look at some key metrics.

10.5 Summary

So was this the negative sentiment around ASML justified? I think for the most part, yes. There were/are many issues that ASML has to deal with, the political interference probably being the most important one.

ASML has mentioned 2024 and 2025 being transition years, as growth was expected to slow down due to the issues mentioned before. 2026 should be a better year.

The stock price dropped close to 50% from the highs of 2024, and personally I believe, this was a bit too much. But more on that later as we look into some metrics and valuation.

11. The opportunity

However, it’s not all doom and gloom. The narrative has drastically changed in the last few months. It’s become very clear that ASML is still in a perfect spot to greatly benefit form the whole AI boom and the CAPEX spend that accompanies this transition.

AI needs super advanced, high-performance chips, and that directly means more orders for ASML’s EUV and High-NA EUV machines. However, it’s still unclear how and when these order will dripple down to ASML.

11.1 Capex Spend

The main trend that will benefit ASML, is increased capex spend on AI and technological advancements. You can see some clear signs of this spending with some of ASML’s largest customers already. Take TSMC: they are ramping up their CAPEX spending to get ready for future demand. In fact, they’re planning to drop up to $42 billion on capex in 2025 alone. On top of that, they’ve signed a deal to invest $100B in the U.S. to build three more factories in Arizona.

SK Hynix CAPEX plans are a;so expected to significantly increase from 2024, reaching over $20B of spend in 2025 and similar levels in 2026. It’s highly unlikely that none of these investments will eventually dripple down towards ASML.

Many of ASML’s customers and customers of their customers, face similar trends. And as we’ve seen in the sector overview, ASML is right in the middle of it all.

11.2 Megatrends

ASML identified some mega trends that are very likely to benefit them. The picture below is a nice summary of that.

It basically comes down to the ever-changing and innovative improvements in the tech field. Whether it’s cars, 5G, cloud or compute, ASML is the key supplier of the machines to produce the chips necessary for these advancements.

11.3 Fundamentals

ASML is an incredibly solid and well-oiled machine. They have high margins (50% gross and 30% net, which is phenomenal for an equipment manufacturer. These margins are steady, and remain steady even during weak parts of the cycles. But more on that later. Their growth is still steady and on top of that they do buybacks and pay a dividend.

Combine these solid fundamentals with their huge and wide moat, and you have yourself a solid business case.

11.4 Summary

ASML is well positioned to benefit from emerging technological waves like AI, electrification, sustainability, robotics, and space exploration, all of which demand advanced, energy-efficient chips.

If China were to abandon efforts to develop its own lithography technology despite massive investments, it would confirm ASML’s technological dominance and the difficulty of replicating its machines.

Additionally, global moves toward semiconductor self-sufficiency, driven by concerns over dependence on Taiwan, are leading to more chip fabrication plants (fabs) worldwide. While this may lower fab utilization, it boosts ASML’s business, as each new fab requires its essential lithography machines.

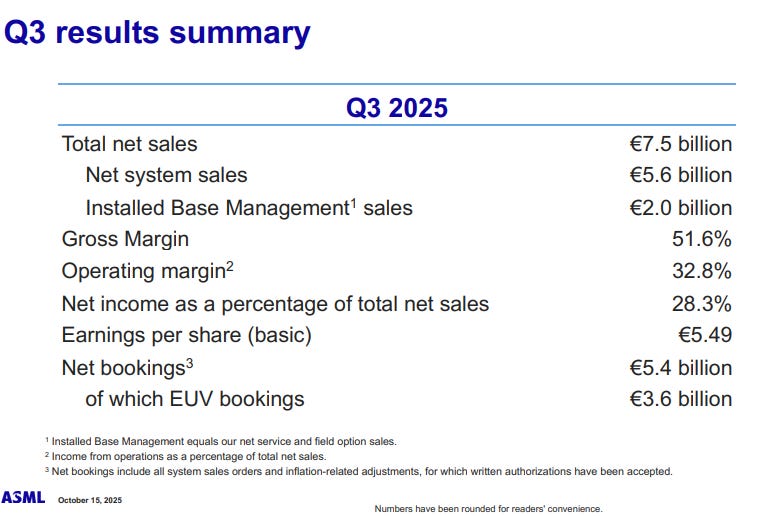

12. Q3 Earnings recap

Since their Q3 earnings were only recently, I could not release this deep dive without mentioning the most important parts of this earnings report. However, I will keep it it very short, as I’ve written a more extensive analysis on these earnings just recently. You can find the post through this link: ASML Q3 earnings review.

Summary of earnings

Revenue came in slightly below expectations, but they beat on EPS and net bookings.

They also announced a new buyback program, starting in 2026.

They also gave an outlook for 2026, which was highly needed as in Q2 the lack of guidance tanked the share price. ASML wouldn’t be ASML if they didn’t phrase it like this:

We do not expect 2026 total net sales to be below 2025’’.

They also mentioned, and this is important, that China sales are expected to decline significantly. However, this was expected as China sales have been lower for the past year. This was not seen in sales, as ASML was still working through China backlog.

Q4 is expected to be strong, with net sales between €9.2 billion and €9.8 billion, and a gross margin between 51% and 53%’’

ASML sees strong trends that benefit them, both from a technological as market perspective.

13. Financials

Let’s dive into some financial numbers!

13.1 Revenue

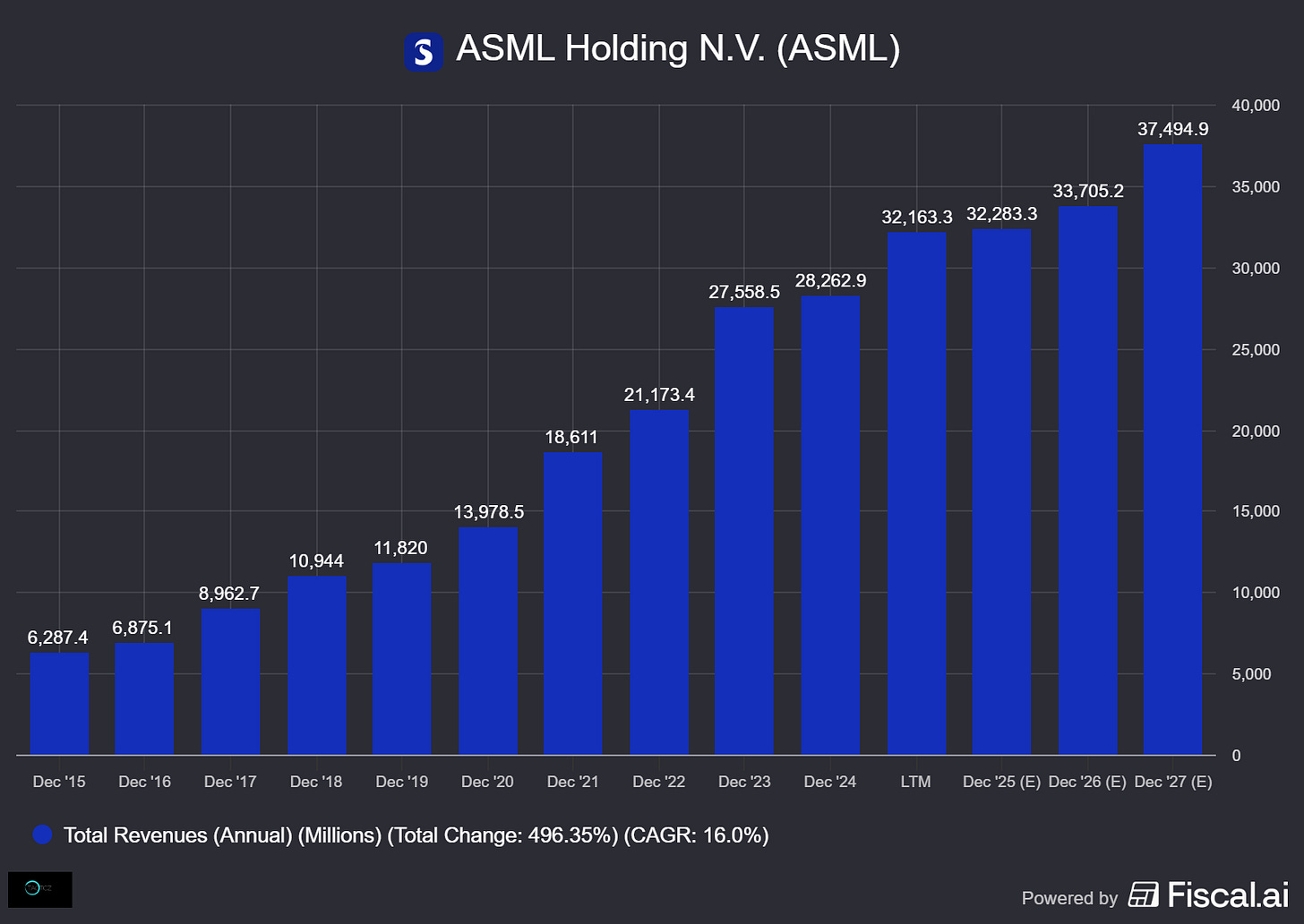

13.1.1 Total Revenue

Revenue has been steadily going up since 2015, compounding at a CAGR of 16%. The strong growth between 2015 and 2022 has stagnated somewhat. The revenue CAGR of the last 5 years still comes in at 20.3%. Revenue expectations for the next 2 years, sit around 10%.

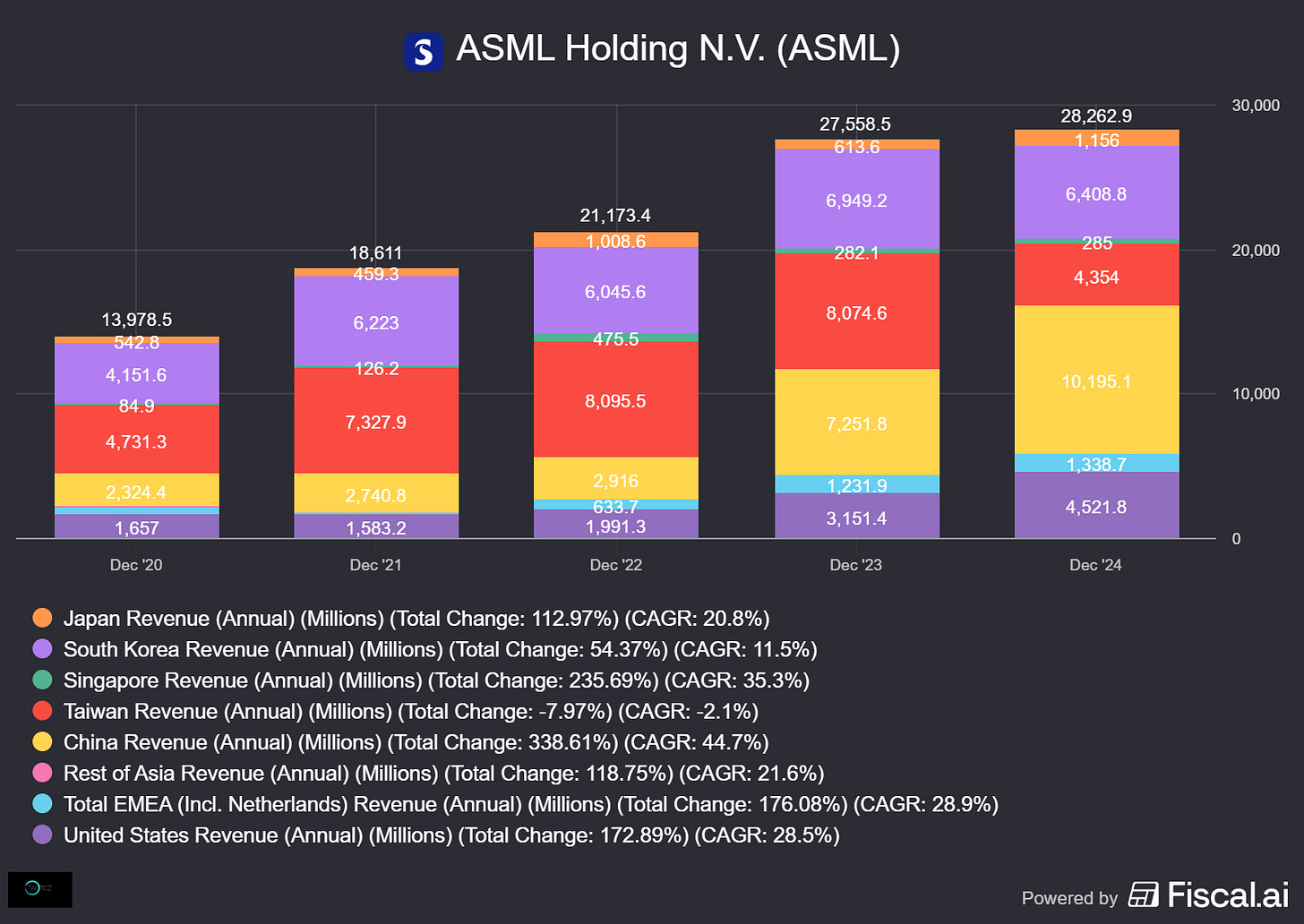

13.1.2 Revenue distribution - geographically

Below you can find a breakdown of ASML’s revenue, based on geography.

As you can clearly see, a lot of the growth in the past years has come from China. As mentioned before, it remains worrisome to still see so much exposure to China, due to the export restrictions enforced by the US and Dutch Government. However, this was known to ASML, and they have taken this slowdown in consideration when giving out their 2026 and 2030 guidance.

13.1.3 Revenue distribution - segment

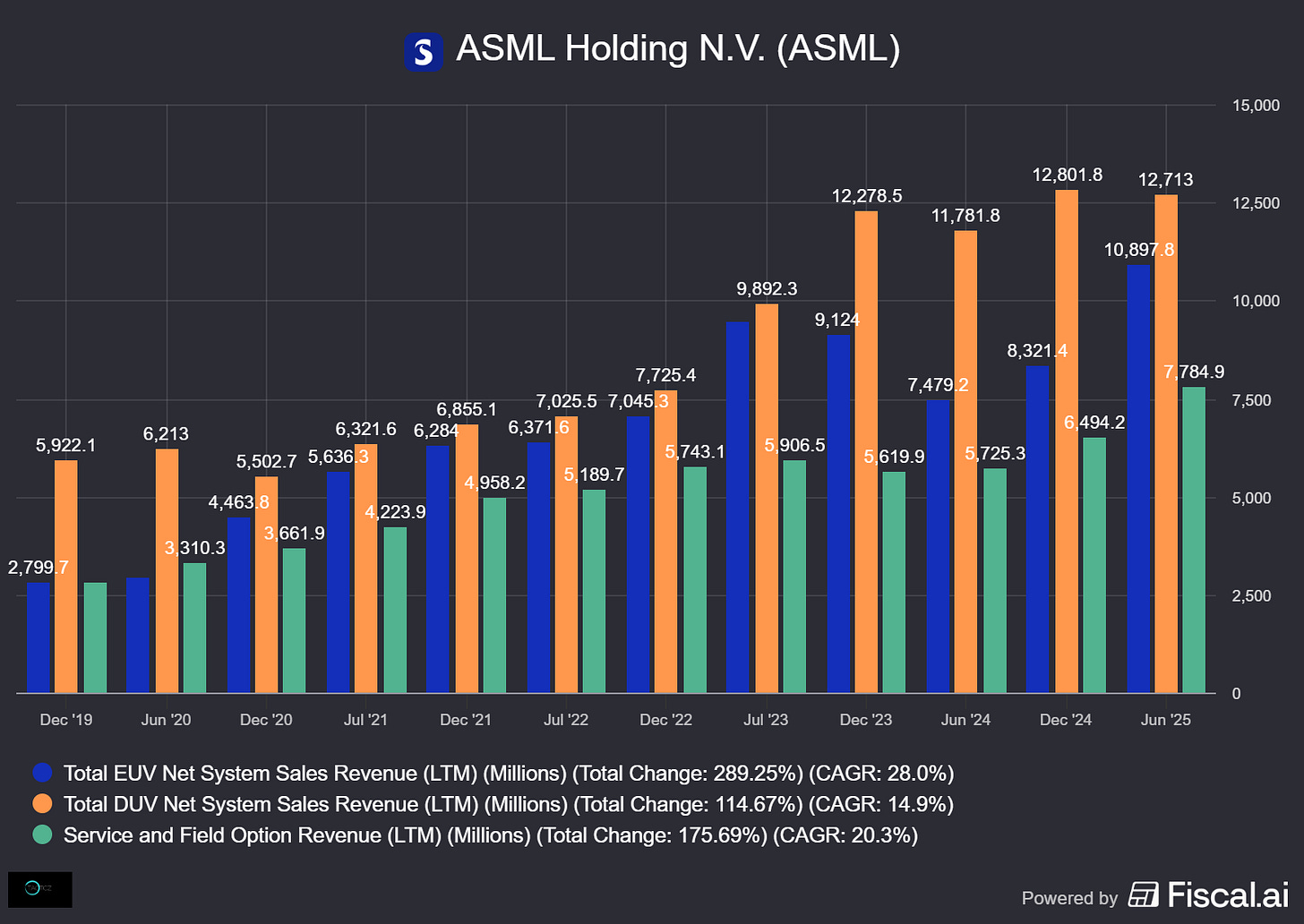

Below you can find a breakdown of ASML’s revenue per segment, differentiated between DUV, EUV and service and field option revenue.

Most of the growth of the last 5 years stems from the EUV sales, which has grown at a CAGR of 28% since 2019. DUV grew at a 14.9% CAGR and Service and Field option revenue at a solid 20.3%

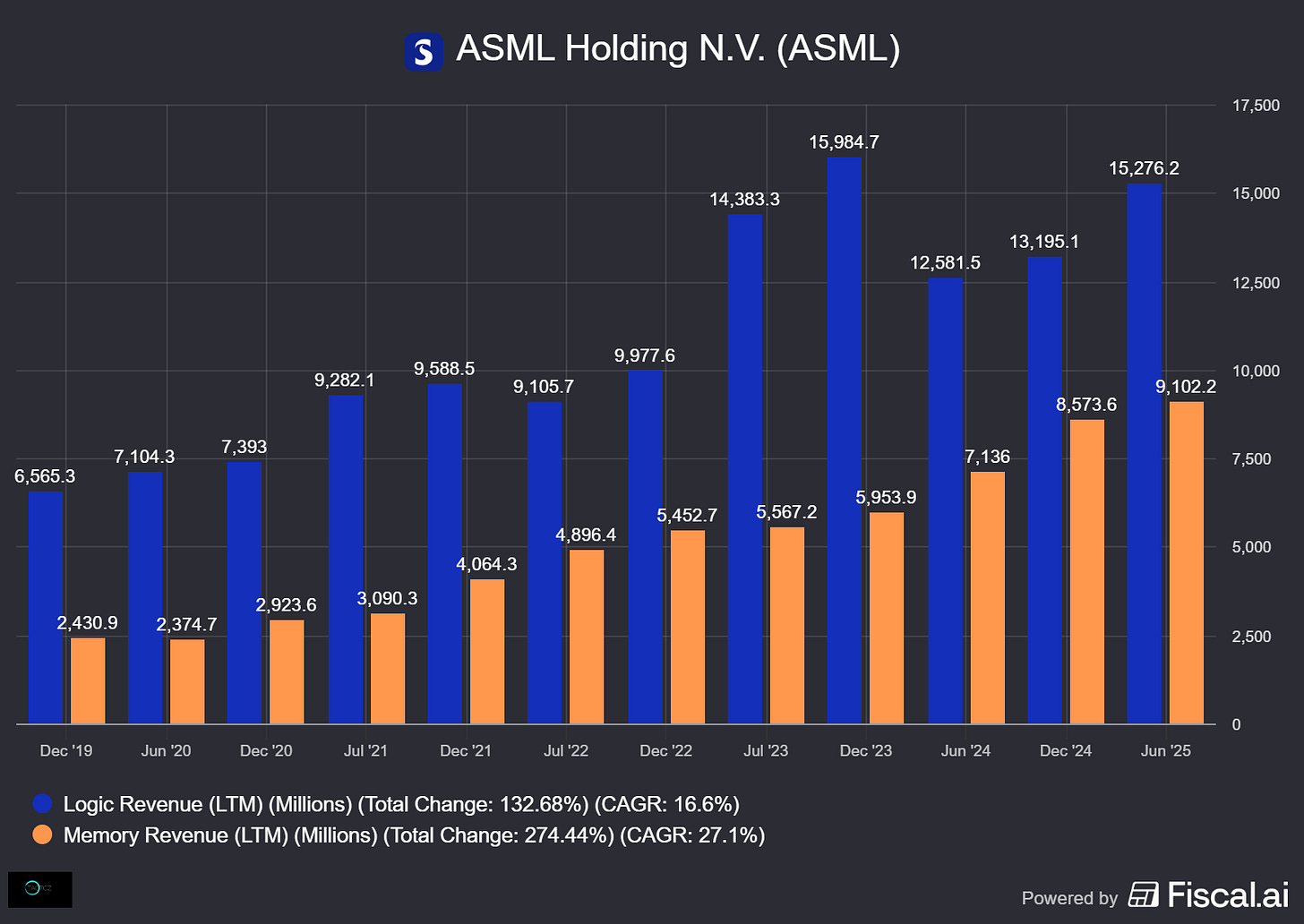

Below chart shows that the majority of ASML’s revenue still comes from LOGIC, but memory revenue has been growing fast as well, at a 27.1% CAGR since 2019.

13.2 Net Bookings

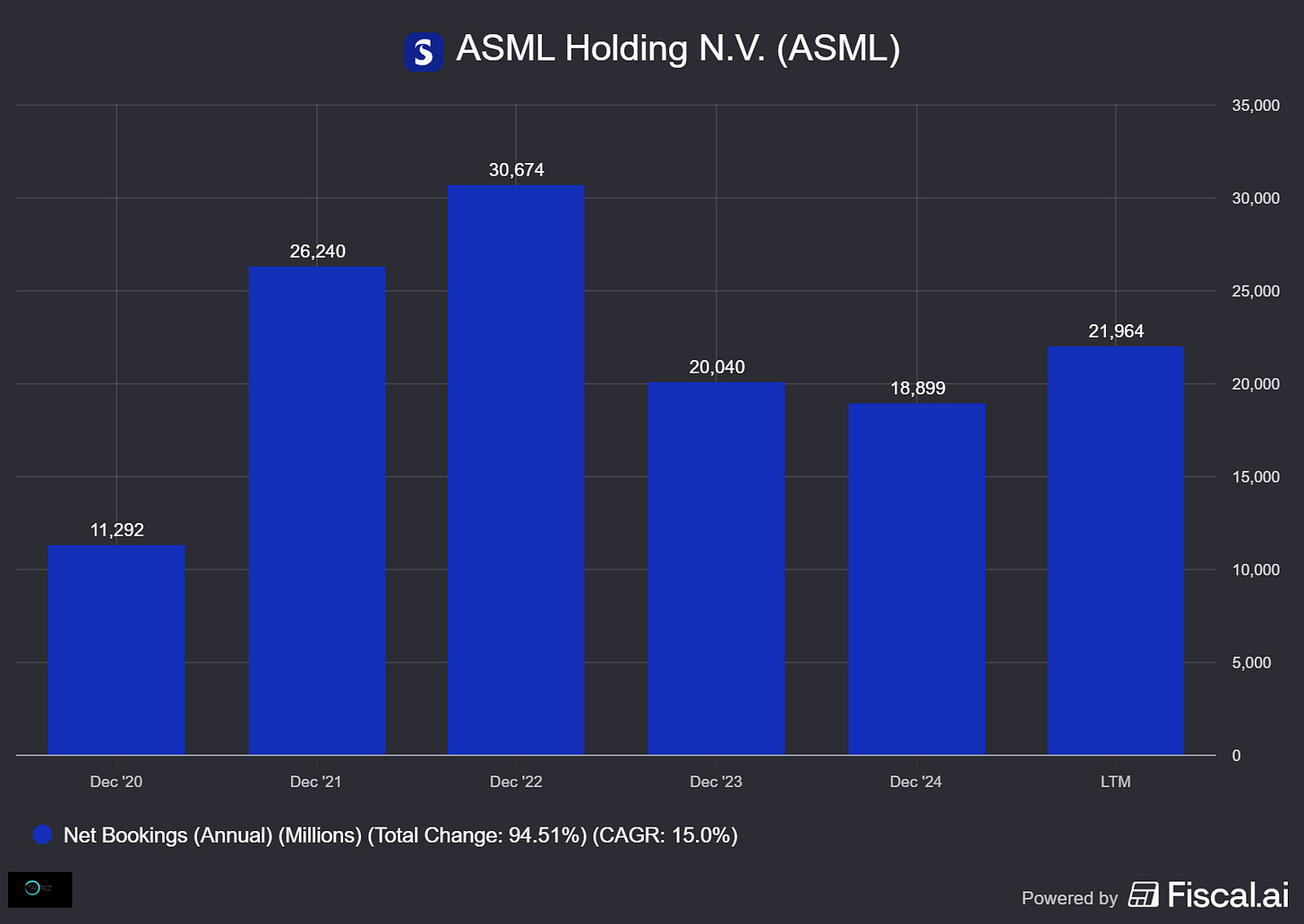

One of the key metrics investors look at when analyzing ASML’s performance, are their net bookings. As you can see, a clear stagnation since 2023.

Net bookings represent the total value of new equipment orders ASML has received from customers for its lithography systems and it is seen as a leading indicator for future revenue.

ASML has announced that they will stop reporting net bookings from 2026. ASML’s CFO, Roger Dassen, has stated that the company’s guidance is a better indicator than net bookings and that “less is more,”.

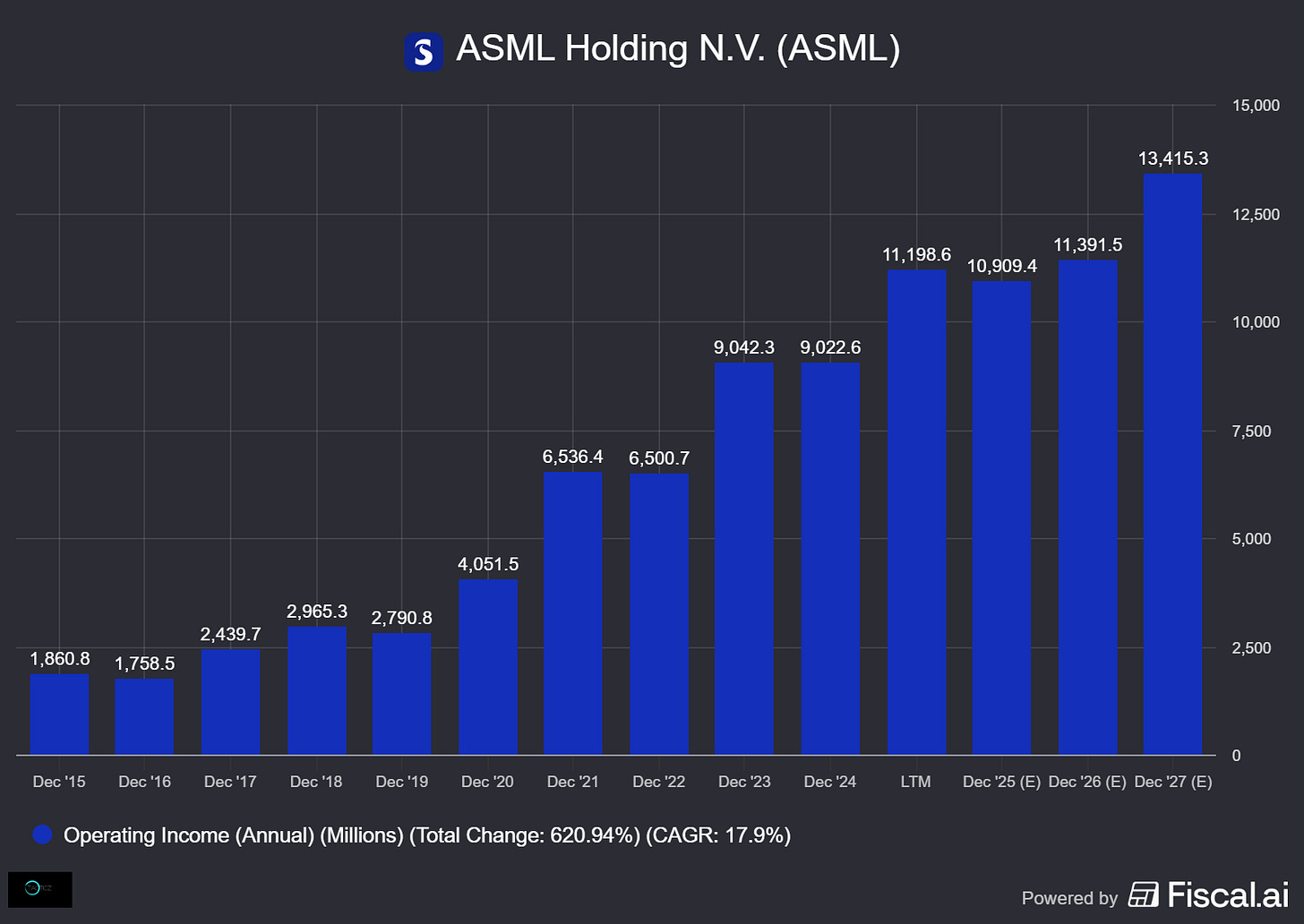

13.3 Operating Income

ASML’s operating income has grown at a very steady 17.9% CAGR since 2015. ASML’s operating income over the last 10 years generally shows a strong upward trend, which reflects the company’s critical and growing position in the global semiconductor industry.

The growth in operating income has been particularly sharp from 2020 onwards, more than doubling between 2020 and 2023

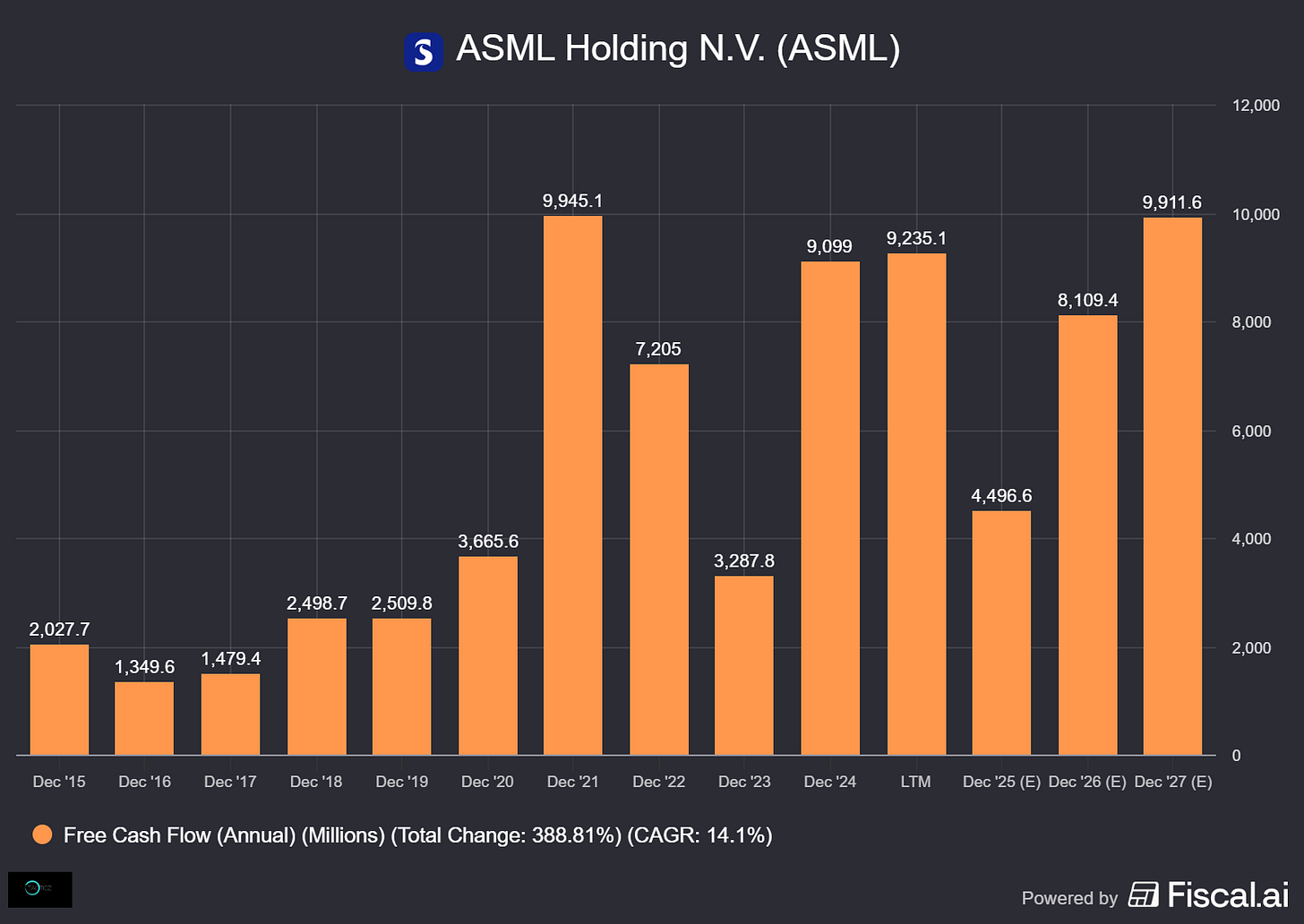

13.4 Free Cashflow

Unlike the steadily rising operating Income, the FCF figures show significant year-over-year swings. But overall, ASML’s free cashflow looks strong. There have been a couple of ‘‘weak’’ years, but these can be directly contributed to increased capex and R&D spend.

ASML’s free cash flow has grown at a 14.1% CAGR since 2015.

13.5 Margins

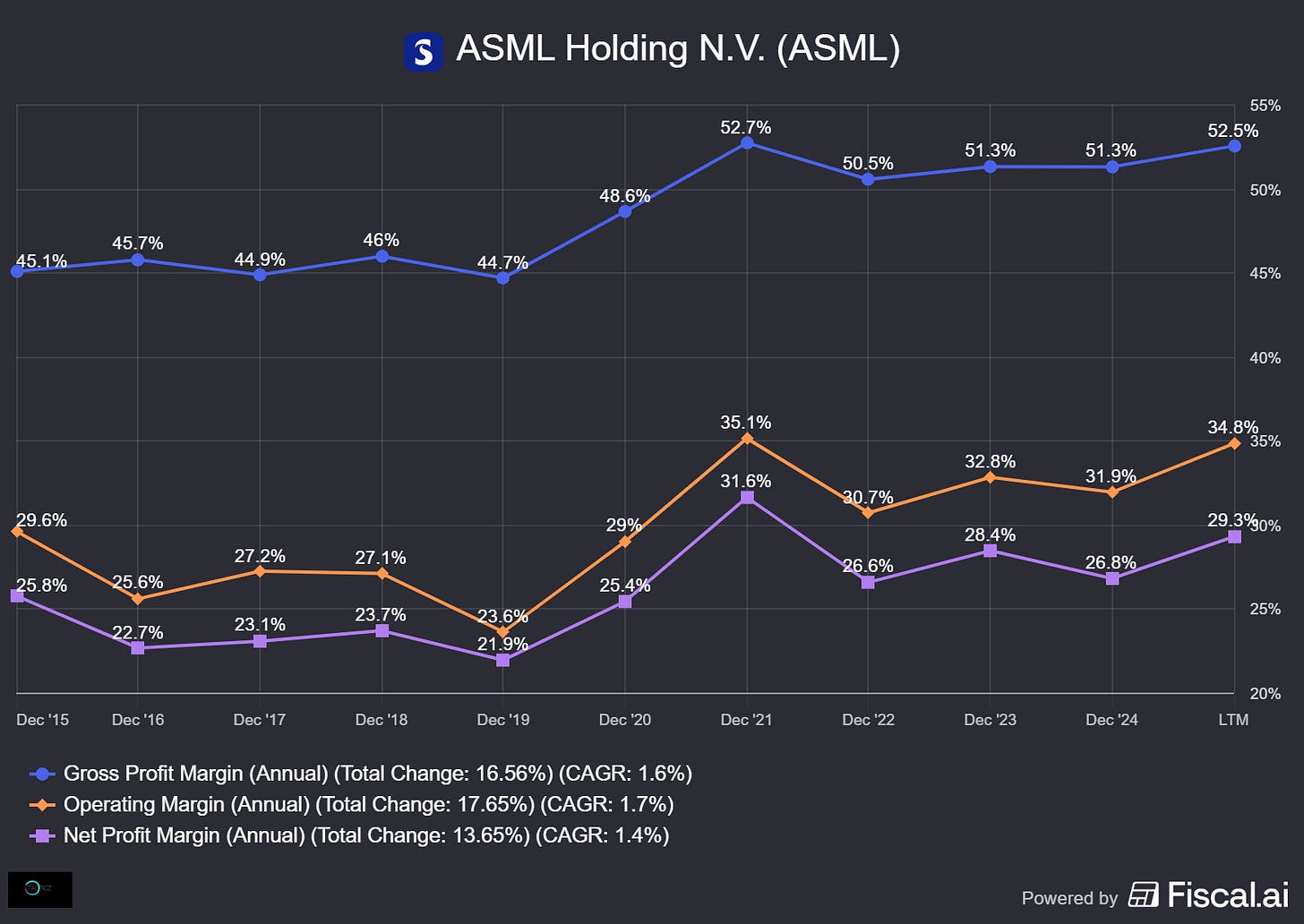

Something quite unique for a company like ASML, are high margins. These high margins are a direct result of the monopolistic nature of the company. This gives them strong pricing power. Also, keep in mind, the barrier to entry in ASML’s field is extremely high, so they have the ability to keep margins like this in the future as well.

Gross margin: 52.5%

Operating margin: 34.8%

Net profit margin: 29.3%

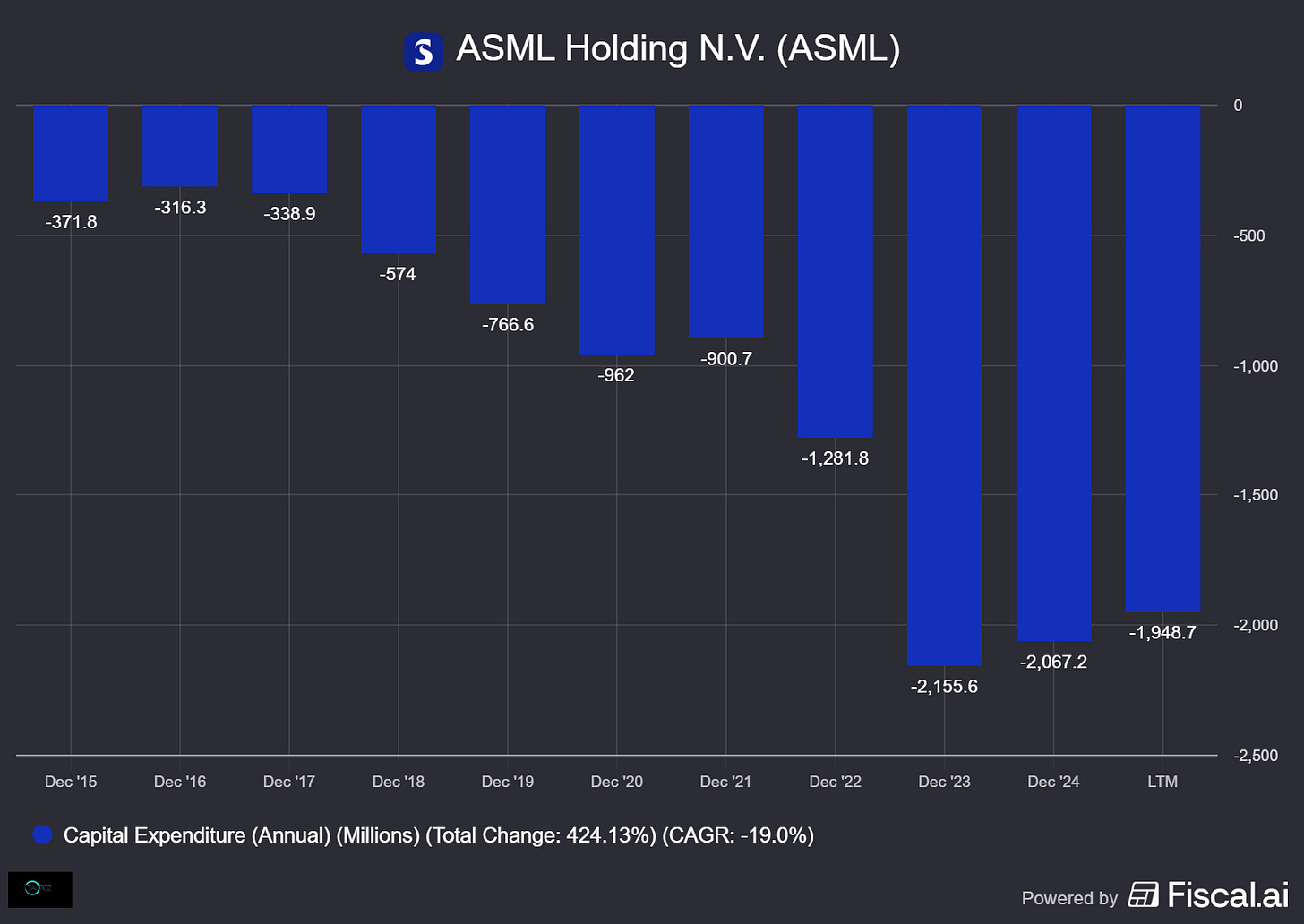

13.6 Capital expenditures

ASML is quite a capex heavy company, as you can clearly see in the chart below. To stay ahead, (and to keep up with demand) they are required to heavily invest in new sites and facilities. Another thing they spend a lot of cash on is manufacturing equipment. They have to acquire the specialized tools and precision machinery needed to assemble and test their lithography systems.

The biggest capex driver is the need to build and equip new cleanrooms and assembly halls to increase the output of their EUV and High-NA EUV machines.

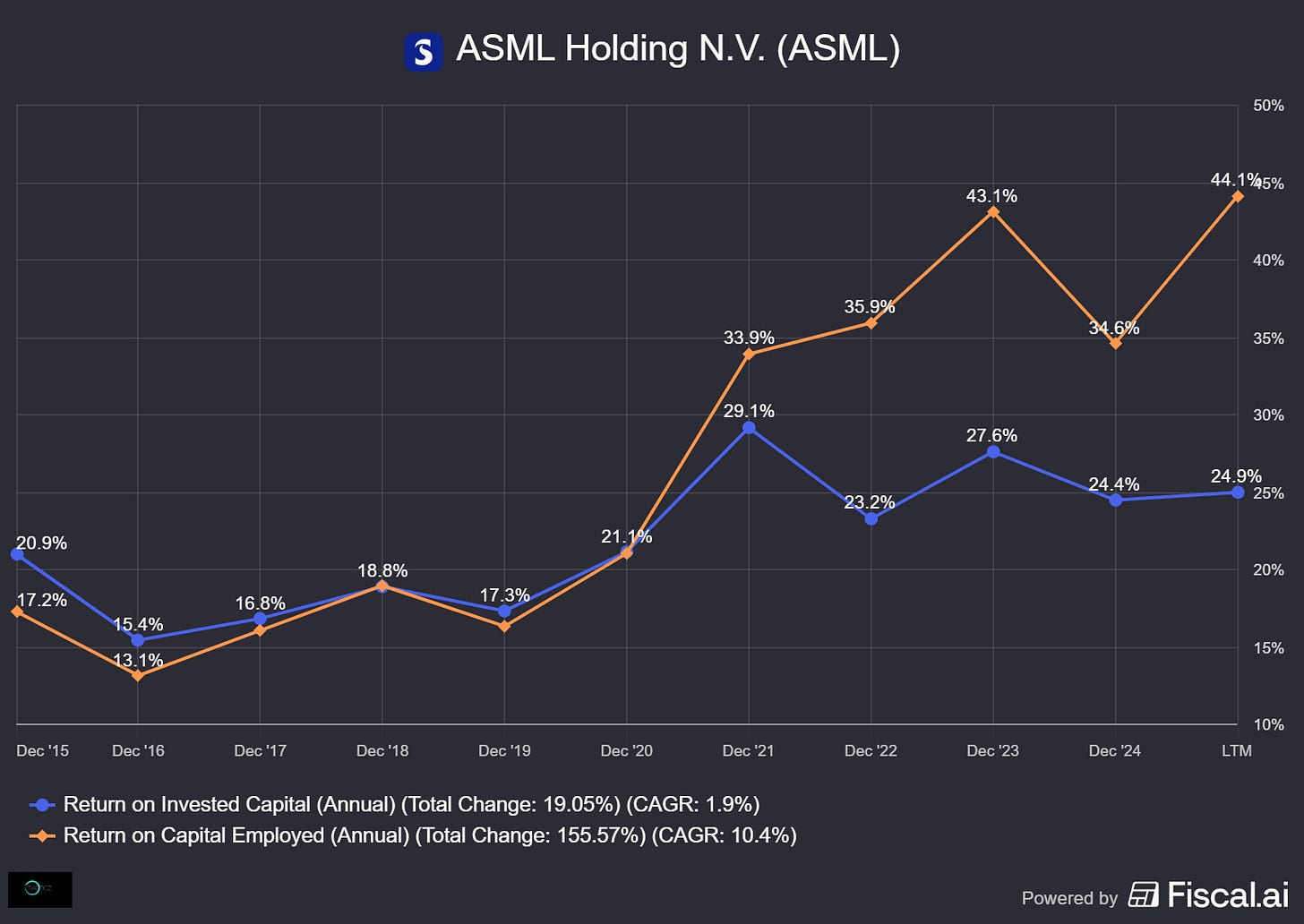

13.7 ROIC and ROCE

For some people such a high capex spend would be worrisome. But keep in mind, ASML’s has proven to be an excellent capital allocator over the years. And their ROIC and ROCE reflect that.

ROIC shows how efficiently a company turns its invested capital into profits and ROCE measures how well a company uses all its capital to generate operating profit. Both these metrics have been rising since the inception of ASML

Current ROIC is: 24.9%

Current ROCE is: 44.1%

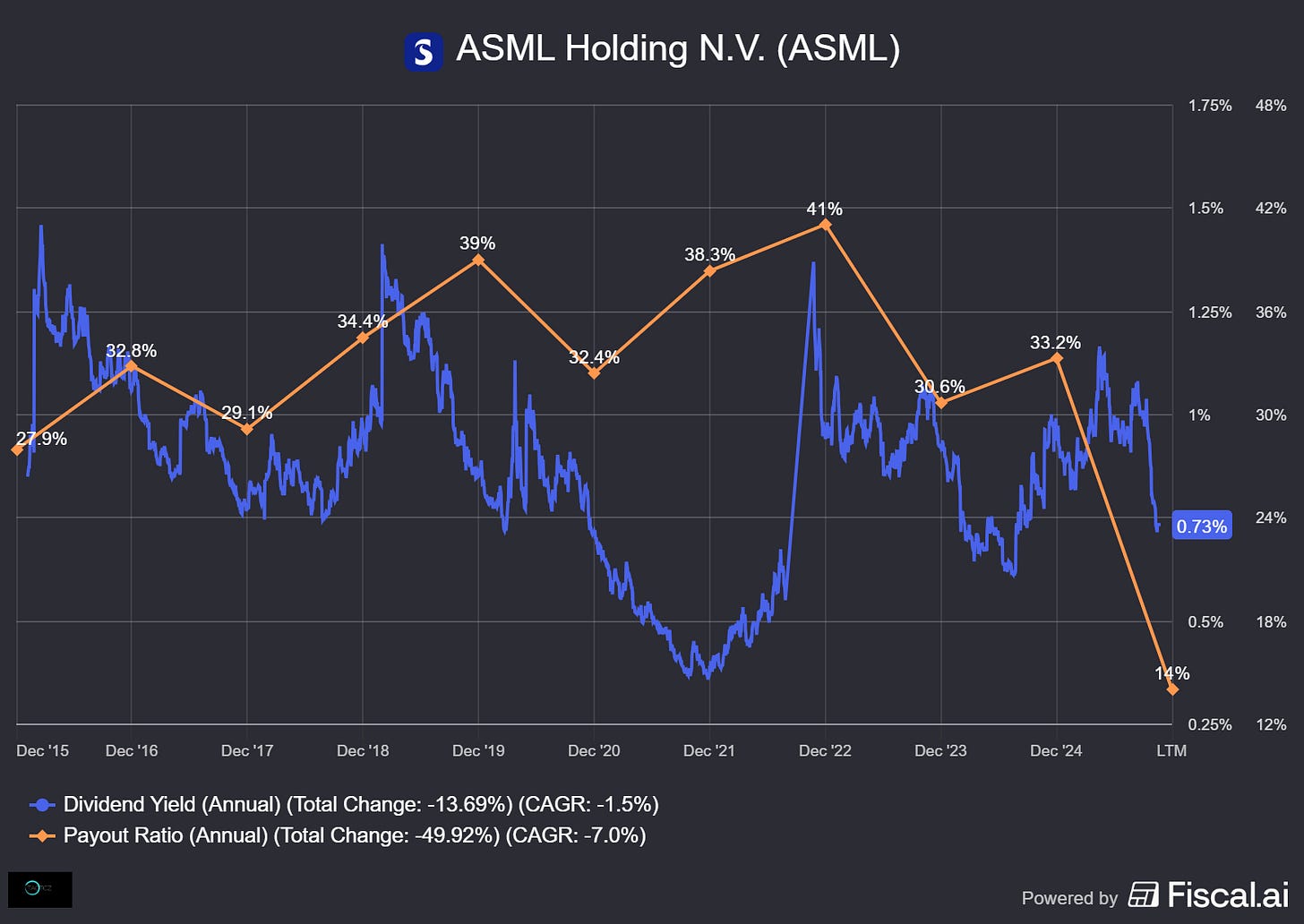

12.8 Dividend

Albeit quite small, ASML does pay a dividend. As the share price has risen over 40% lately, the yield has since dropped to about 0.73%.

The payout ratio is quite low, as ASML uses most of it’s earning to reinvest or buybacks.

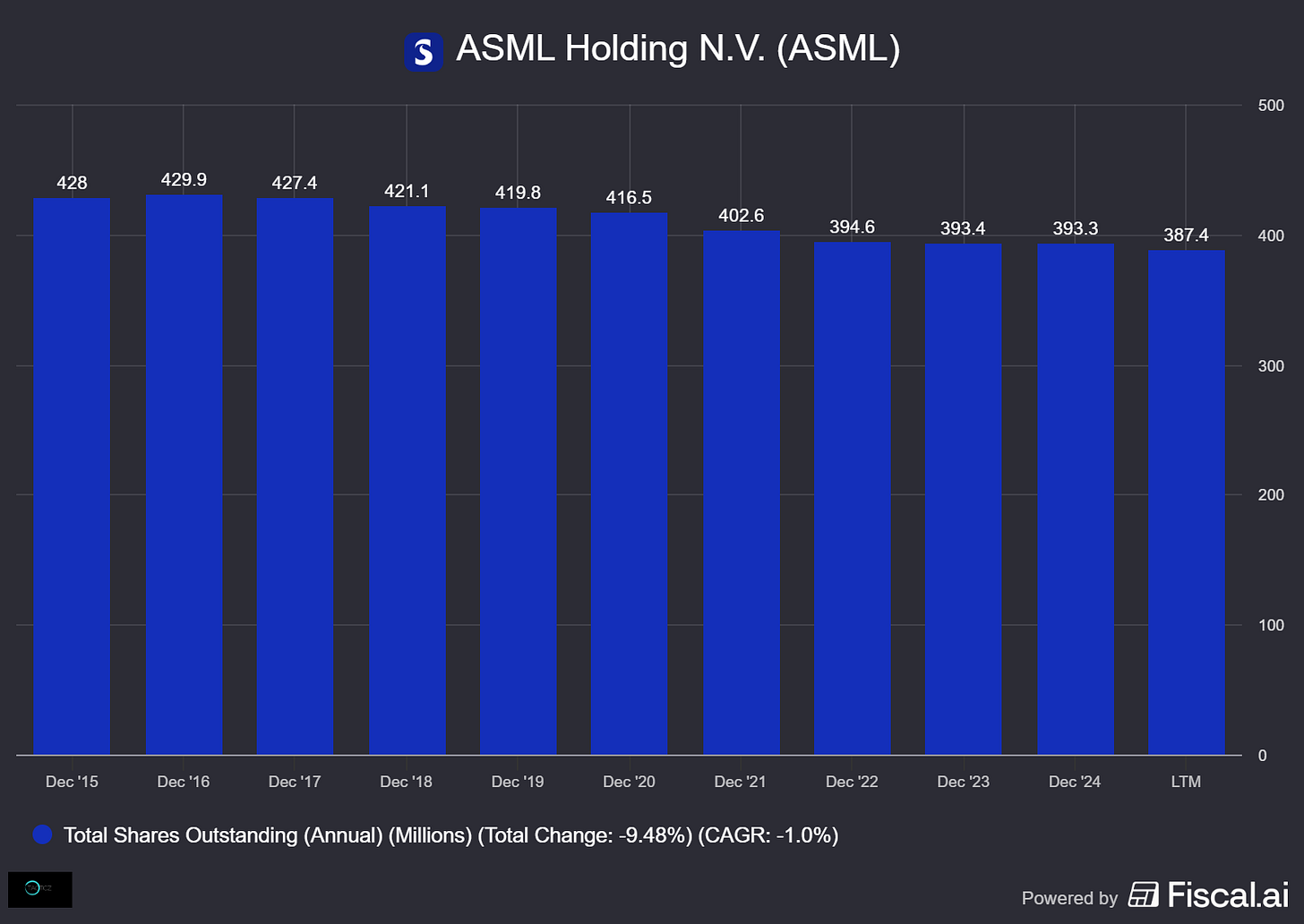

12.9 Buybacks

ASML is known to have a good and balanced buyback strategy. Overall, they allocate money to these buybacks when the prices are ‘‘cheap’’ and they refrain from repurchasing when the price is ‘‘expensive’’.

They have decreased their share count at a CAGR of -1% in the last decade and I expect this trend to continue. As mentioned before, they recently announced a continuation of buybacks in 2026.

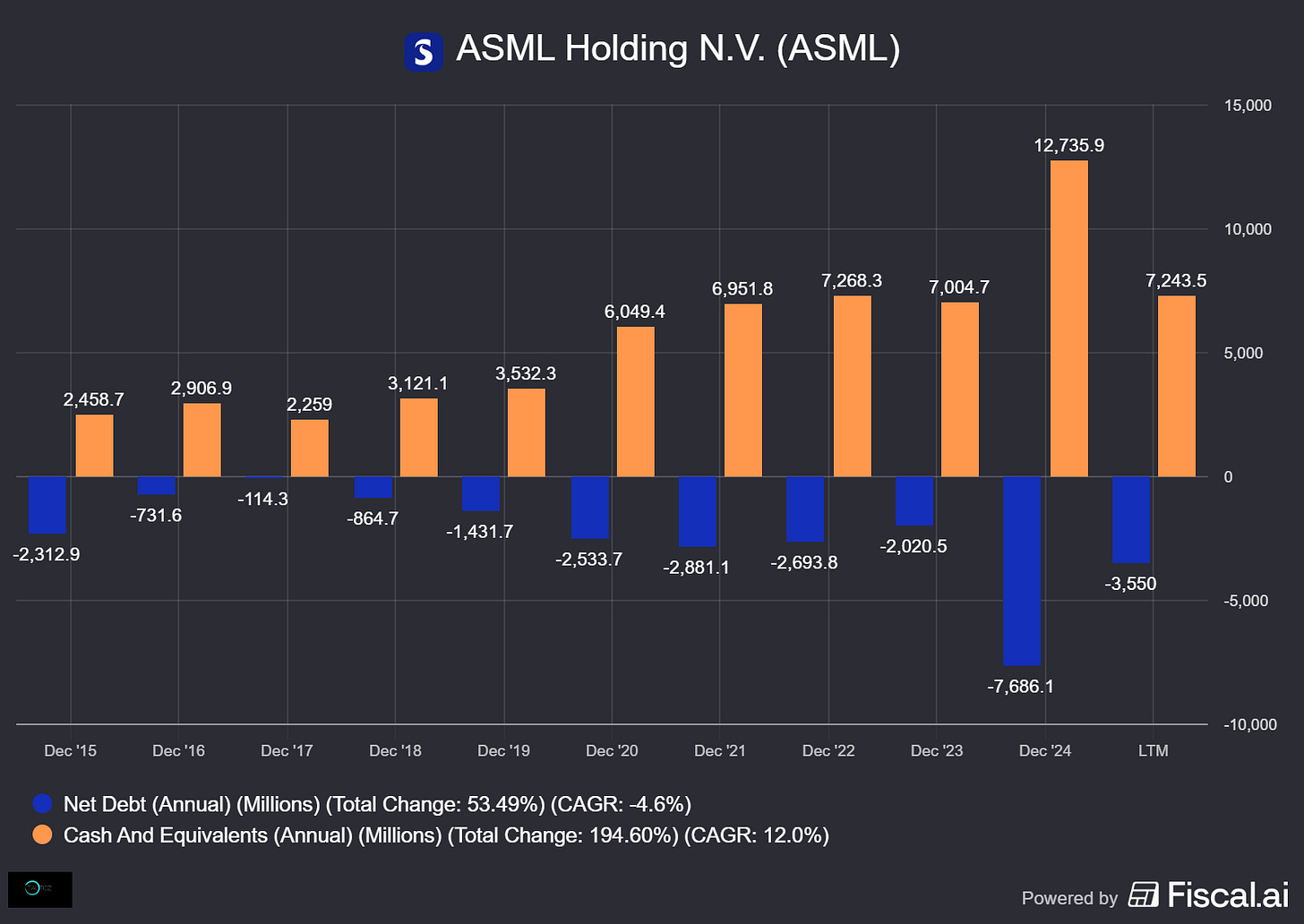

12.10 Balance sheet

You can essentially sum up ASML’s balance sheet over the last decade in one phrase: They’ve been stacking cash, growing like crazy, and are financially bulletproof.

The balance sheet appears strong due to high cash reserves, which exceed the debt and a decreasing debt-to-equity ratio. They have a significant amount of cash and short-term investments, and its operating cash flow is high enough to easily cover the debt and interest payments.

13. Valuation - Metrics

13.1 Forward PE

A lot has changed since two months ago. ASML was trading at (in my opinion) very low and attractive levels. Recently, after the run-up, things have normalized.

ASML now trades at a forward PE of 38.5, which is quite lofty and far above the 10 year median.

In my opinion a forward PE of 30 is more justified.

13.2 EV/EBITDA

The same applies to the EV/EBITDA multiple, which currently sits just below the 10 year median of 28.96.

The EV/EBITDA multiple essentially tells us how many years of cash flow (approximated by EBITDA) it would take to buy the entire company.

The current multiple seems fair to me.

13.3 Forward price/ OCF

The same trend on the price/OFC multiple. Not cheap, not expensive, but fair in my opinion.

The P/OCF indicates how many dollars an investor has to pay for one dollar of a company’s operating cash flow.

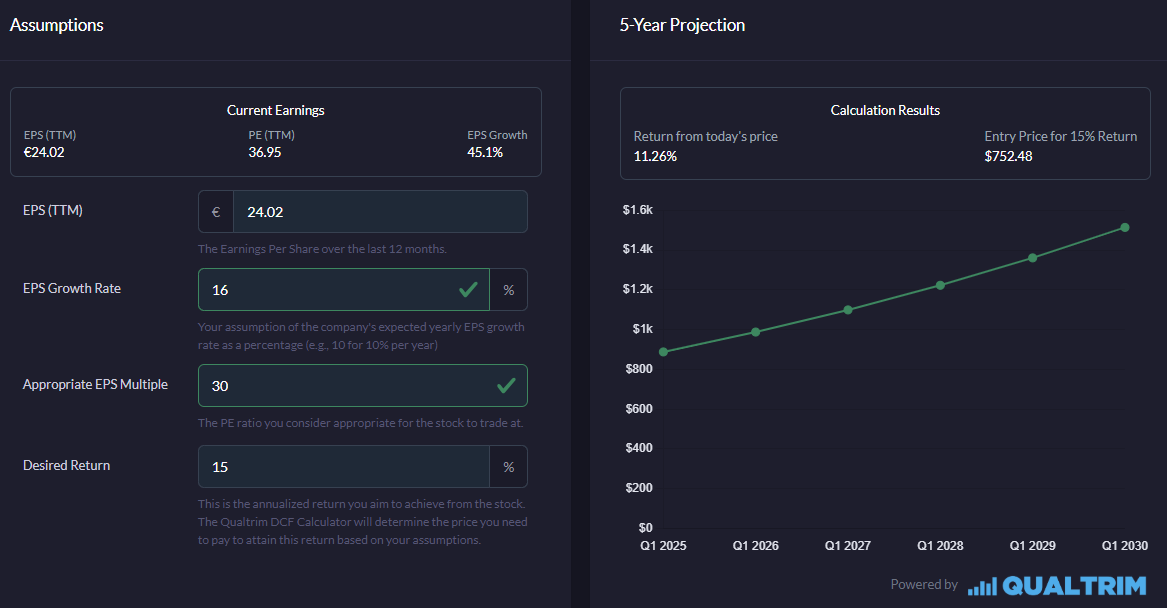

13.4 EPS calculator

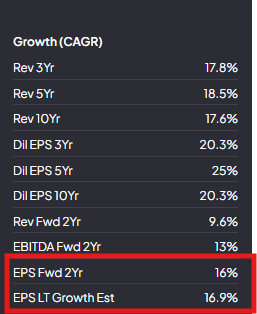

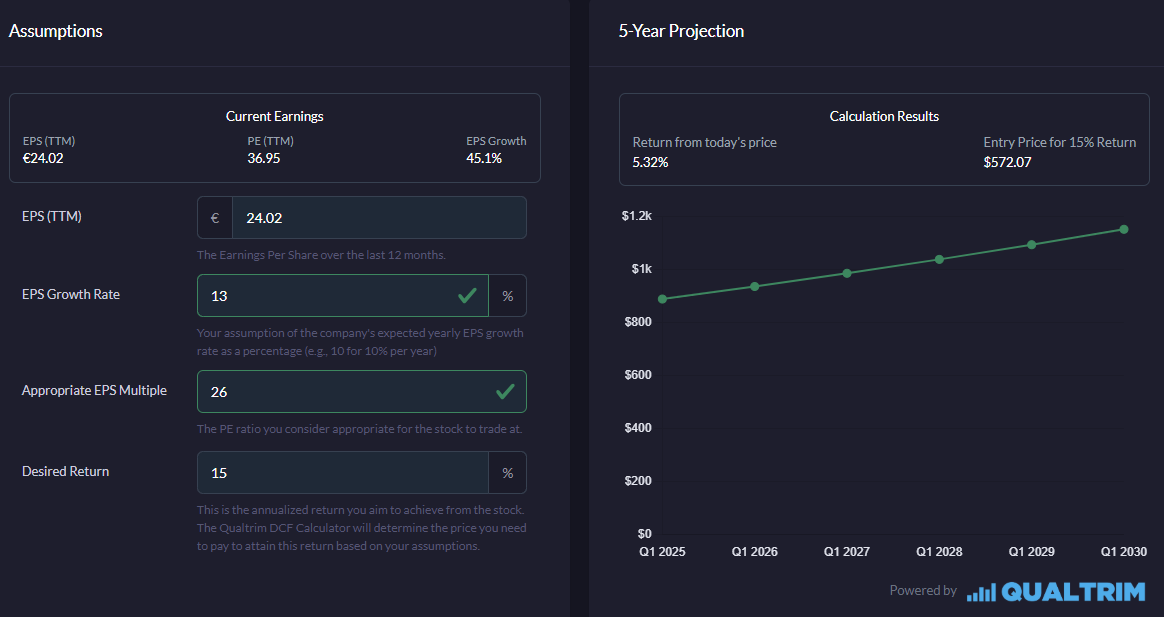

Before we get to the big valuation chapter, with my bull, base and bear case, I also ran ASML’s numbers in Qualtrim’s EPS calculator.

EPS growth is 16% and we took a 30 PE exit multiple: this would give us a return of 11.26% from today’s price. Market beating, but not spectacular.

One could argue that this is still a bit too optimistic, even though EPS forecasts on fiscal.ai do point towards the 16% CAGR for the next few years.

Let’s take some more conservative numbers and a lower exit multiple. An EPS CAGR of 13% and an exit multiple of 26 gives us a 5.32% from this point.

Of course, this is an overly simplified way of looking at valuation, but it does give a nice first indication about the valuation.

13.5 Metrics summary

Overall, ASML does not look as cheap as it did a couple weeks ago. I still think there is value to be found here, but the no-brainer valuations we saw a couple weeks ago are gone for now. In the next chapter I will present my extensive valuation, and we reach a slightly different conclusion.

14. Valuation - Bear, Base and Bull case

Below valuation model is based on management’s guidance for 2030. The framework and analysis I made together with

. He’s a great Dutch content creator here on Substack as well, so please make sure to check him out!This is ASML lates long-term guidance (2030):

Revenue between €44 billion and €60 billion. The midpoint is therefore €52 billion.

Gross profit margin between 56% and 60%. The midpoint here is 58%.

Based on this guidance, we can create a bull, bear, and base case:

Bull case: ASML achieves €64 billion in revenue in 2030 with a gross profit margin of 64%.

Base case: ASML reaches the midpoint of the guidance, €54 billion in revenue with a 60% gross profit margin.

Bear case: ASML barely meets its guidance with €44 billion in revenue and a 56% gross profit margin.

Note: for both my base and bull case I’m slightly above management’s own forecast, as I think they are too conservative and the current AI narrative should lead to higher than expected growth.

Below is some data we will use as input for our valuation:

Expected total 2025 revenue: €32,449B

Current gross profit margin: 52.5%

Current EBIT margin: 37.6%

Current Net profit margin in 2024: 29.3%

Current share outstanding: 387.3 million

Current tax rate: 17.8%

Historical growth figures:

5-year revenue CAGR: 19% from 2020 to 2024

5-year average EBIT margin: 31.92%

5-year average gross margin: 50.88%

5-year average net profit margin: 27.76%

5-year average P/E ratio: 38.9 (current P/E: 25.9)

5-year average change in shares outstanding: -1.5% per year (expected ±-3% in 2025)

For tthis valuation model, a full view of the cost structure is needed:

R&D costs: 15.2% (5-year average: 16.6%)

S&G costs: 4.0% (5-year average: 4.08%)

Bear/Base/Bull case based on a P/E multiple

To carry out this valuation, a few variables must be estimated independently, as management has not provided guidance for them. These are:

Net profit margin

Change in shares outstanding

Exit multiple (P/E) that investors are willing to pay in 2030

To calculate the net profit margin, we can use the management’s gross margin guidance (56–60%).

From the gross profit, two main cost items must be deducted to reach EBIT: R&D and S&G expenses. After this, we account for net interest income/expenses and taxes to arrive at net profit. These variables (costs, share count, and P/E) will differ per scenario.

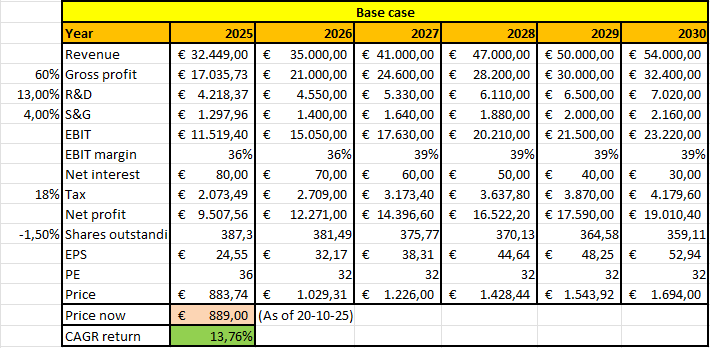

14.1 Base Case

Let’s start with the base case scenario.

In this base case, I assume revenue of €54 billion in 2030, with a gross margin of 60%. This implies a revenue CAGR of 10,74% from today’s price.

From the gross profit, R&D and SG&A costs must be deducted. In this base case, I assume an operating leverage: revenue grows faster than these costs, causing the percentage of R&D and SG&A expenses relative to revenue to gradually decline to just below the five-year average. Specifically, this means an R&D ratio of 13% and SG&A costs of 4% in 2030, which is a slight decrease for the R&D costs and break-even for SG&A costs compared to current levels.

For the financial position, I assume a slightly increasing cash balance, stable debt, and declining interest rates. As a result, interest income remains limited and decreases to €30 million in 2030. For the tax rate, I assume an average of 17.8%. which is the current tax rate.

The net profit margin reaches 31% in 2030, compared with 26.8% now and 27.7% on average over recent years. In this scenario, operating leverage is therefore present but limited. Net profit amounts to approximately €19 billion.

The number of outstanding shares decreases by an average of 1.5% per year, in line with ASML’s five-year average. As a result, earnings per share (EPS) rise to €52,94 in 2030.

For the price-to-earnings (P/E) ratio, I expect a slightly more positive market sentiment in 2030. The historical average of 38 will no longer be reached, but the P/E comes in at 32, a slight decrease from the current 38. This results in an expected share price of €1,694 in 2030, equivalent to an annual return (CAGR) of 13,76% from the current level.

As you can see, this would be a very solid return and would be in line with the market. I do however think, that my assumptions here are not very aggressive and my base case is still rather conservative (which is in line with management’s stance)

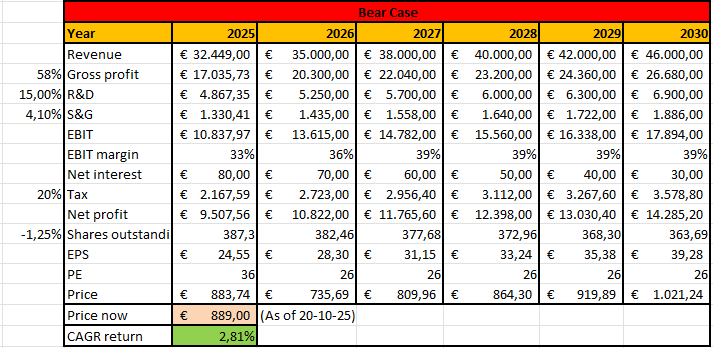

14.2 Bear Case

In this bear case, I assume revenue of €46 billion in 2030, with a gross margin of 58%. This implies a revenue CAGR of 7.25% from today’s price.

I assume an R&D ratio of 15% and SG&A costs of 4,1% in 2030, which is a slight increase compared to current levels.

For the tax rate, I assume an average of 20%, which is 2.2% higher than the current tax rate.

The number of outstanding shares decreases by an average of 1.25% per year, which is lower than ASML’s five-year average. As a result, earnings per share (EPS) rise to €39,28 in 2030.

For the price-to-earnings (P/E) ratio, I expect a a very conservative and bearish sentiment in 2030. The historical average of 38 will no longer be reached, and the PE falls to 26. Which in my opinion, is extremely low for a high quality monopolist like ASML. This results in an expected share price of €1,021,24 in 2030, equivalent to an annual return (CAGR) of only 2.81% from the current level. But this scenario seems highly unlikely to me.

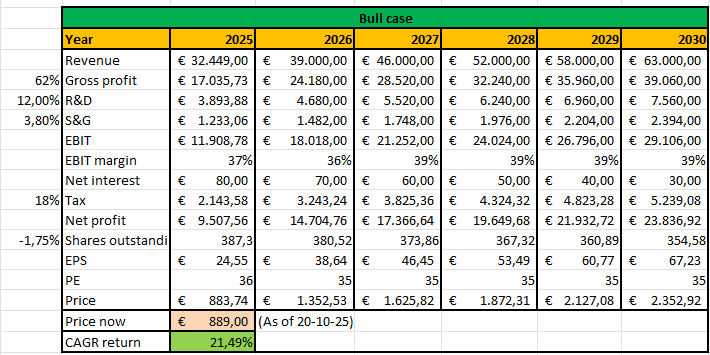

14.3 Bull Case

In this bear case, I assume revenue of €63 billion in 2030, with a gross margin of 62%. This implies a revenue CAGR of 14,23% from today’s price. This is above’s management own forecast-range for 2030, but I think it’s doable when things align perfectly for ASML.

I assume an R&D ratio of 12% and SG&A costs of 3,8% in 2030, which is a a strong decrease compared to current levels.

For the tax rate, I assume an average of 17.8%, which is the same as the current tax rate.

The number of outstanding shares decreases by an average of 1.75% per year, which is higher than ASML’s five-year average. As a result, earnings per share (EPS) rise to €67,23 in 2030.

For the price-to-earnings (P/E) ratio, I expect a bullish but reasonable sentiment in 2030. The historical average of 38 will no longer be reached, but a 35 PE is still quite high, but not at all unreasonable. This results in an expected share price of €2,352,92 in 2030, equivalent to an annual return (CAGR) of 21,49% from the current level.

14.4 Weighted CAGR

Let’s put a weighting to these different valuations. I think the likelihoods of the different scenario’s are as follows:

Base-case: 60%

Bull-case: 25%

Bear-case: 15%

This gives us a Weighted CAGR of 14.05%. That’s just below my 15% that I aim for when researching companies.

14.5 Summary Valuation

From today’s price, I think ASML still looks reasonably priced. Not as cheap as it was a couple months ago, as the multiples were a lot more compressed. ASML is supposed to trade at premium, due to the high quality nature of the business, but I prefer adding to my position valuation is just a tad more attractive. It will require some patience, but as the recent months have shown, there will always be another opportunity.

15. My plan and approach

So, what are my plans with ASML? It might not come as a surprise if you’ve read this thesis, but I’m in holding mode. Right now, I don’t think ASML is a screaming buy, although I still believe it will deliver solid returns in the future.

ASML is the largest position in my portfolio, and I’m very happy keeping it that way. This is a company you can buy and forget about

Will it be smooth sailing from here? No, it won’t. ASML is prone to big downturns, and if there is overall weakness in the (semiconductor) market, ASML will have its bad times as well.

For me, ASML is a multi-year (maybe decade-long) bet on one of the most important companies in the world. It’s a long-term investment in the company’s huge moat, strong management and the AI tailwinds that will benefit them in the upcoming years.

I will add to my position when the price falls and valuation looks more attractive. Right now, I’m sitting on my hands. There’s nothing else to do but watch management execute and continue this major growth trajectory.

Investing is about patience. Waiting for the right time. And that’s exactly what you have to do with a company like ASML as well.

There is no rush. Take your time.

16. Closing words

If you have made it this far, thank you! I hope it was worth your time.

Keep in mind that I am not a semiconductor expect. This deep dive was my own research and my attempt to understand ASML just a bit better than I did before. I’m just sharing my insights and thoughts here.

I would highly appreciate any feedback, negative or positive. I still have a lot to learn, both in my writing and the way I conduct my analyses.

Any like, share, repost or comment truly helps me out.

Support me

All my content is free, just like this deep dive. My goal is to share research, ideas, and insights with anyone who finds them useful.

If you’d like to go a step further and support the work behind the scenes, you can choose to become a paid subscriber. Your support helps me dedicate more time to researching, writing, and uncovering opportunities in value investing, while keeping everything accessible for everyone.

Whether free or paid, I’m grateful you’re here. Your support makes this work possible.

Disclaimer below.

Disclaimer

The content I share is for educational and informational purposes only. It should not be considered financial, investment, or trading advice. All opinions expressed are personal views and are not guarantees of future performance. Investing involves risk, including the potential loss of capital, and past results do not indicate future returns.

Before making any investment decisions, you should conduct your own research or seek guidance from a licensed financial advisor. I am not responsible for any financial outcomes resulting from actions taken based on the information provided.

By engaging with this content, you acknowledge and agree that you are solely responsible for your own investment choices.

Thanks for writing this, it clarifies a lot! I'm exited for the deep dive, as ASML always seemed hard to grasp, despite its huge impact on AI.

https://www.reuters.com/world/asia-pacific/us-startup-substrate-announces-chipmaking-tool-that-it-says-will-rival-asml-2025-10-28/#:~:text=US%20startup%20Substrate%20announces%20chipmaking%20tool%20that%20it%20says%20will%20rival%20ASML,-By%20Max%20A&text=SAN%20FRANCISCO%2C%20Oct%2028%20(Reuters,AS)%20%2C%20opens%20new%20tab.

What do you think about this?